WHAT TYPE OF TRADER ARE YOU?

To Blitz, or not to Blitz. That is the Question.

I’ve been spending a lot of time recently thinking about what “Type” of Index Trading Strategy makes the best use of the tools I have at my disposal. I’m naturally an aggressive trader (ie I like to ‘Blitz’ trade at market open), but I’m speaking to more and more traders who take a much more disciplined, patient approach. Even with a strong directional bias or conviction, they are happy to sit back and wait for their levels to be hit (for example, upon open they will set limit orders 10pts above/below market) before entering a trade. I call this a ‘Sniper’ approach.

What approach you use obviously depends on what Tools you use (TA, Macro, Market Depth, Statistical Analysis) and your tolerance for risk. However in general what are the Pro’s and Con’s of each style?

THE BLITZ

PRO’S

Capture a high proportion of large market moves.

Satisfies any feelings of ‘FOMO’.

Ability to get a ‘Feel’ for the market price action, by holding a real P&L during initial moves.

CONS

Poor entry point for the ~74% of days which move at least 10pts in the opposing direction, and the 46% of days which move at least 10pts in both directions.

Initial market stages are often highly volatile, and early unrealised losses can affect mindset and trading discipline and result in errors of judgement.

You are acting on incomplete information until ~10:10am, given the staggered opening auction nature of the ASX.

Higher spread / broker commissions payable

TO SNIPE

PRO’S

Significantly higher Risk / Reward ratio for executed trades, given the better entry point, and higher Win Rate.

Ability to consider additional information during the opening stages which can add to or reduce your trade conviction.

Lower spread / broker commissions payable

CONS

Miss a large proportion of the large day moves. ~73% of large moves (whether higher or lower) on the AUS200 have less than a 10pts move against the primary direction from open (ie Institutions have materially mispriced the SPI vs actual XJO level, and so need to adjust price immediately from open).

For me personally, I really enjoy the daily challenge of trading and particularly the ‘problem solving’ aspect, so the thought of missing a 50pts move when I have high conviction on a trade for the sake of improving my P&L by 10pts is a real struggle to address, mentally.

One the the major problems for me is that I don’t have a regular ‘job’. Being across market moves is my job. This means that the urge to be ‘doing something’ when watching the market is high. I find that when I’m on the golf course, or down the beach and not able to be in front of a computer screen, I’m much more comfortable with simply setting levels, and not getting down on myself if they don’t get hit.

Let’s look at some REAL LIFE examples of how you could trade various situations with these approaches.

Many of you are now subscribed to the TGM High Probability pre-market SMS Alerts, and I know that these have been especially useful to those of you who want to trade high probability setups but have a full time job to manage.

As background, these alerts were born out of a large trading loss I had in November which didn’t ‘make sense’, from a ‘helicopter’ point of view on what the market ‘should’ have done, so I set about to find out why.

I started by backtesting about 5 variables, including the Aus200 Cash opening auction and pre-market moves, and found the conditions under which we can make reliable assumptions as to the likely market direction at a confidence level of >80%.

Let’s look at the history of these alerts since we started as an example:

SHORT HIGH PROBABILITY ALERTS:

So what can we summarise from this?

‘Short’ alerts have a higher probability of failure than ‘Long’ alerts, at around 23%. This makes logical sense in the current market, where the ASX has rallied ~10% in the past few months.

Half of all alerts will reach target in the first 5 minutes of trade. Approximately 60% in the first hour of trade.

The average move to low is ~32pts, suggesting to me that as a general rule, a ‘Take Part Profit’ strategy would be the optimal exit plan here.

LONG HIGH PROBABILITY ALERTS:

So what can we summarise from this:

Long alerts have a higher probability of success than Short alerts, at 87%.

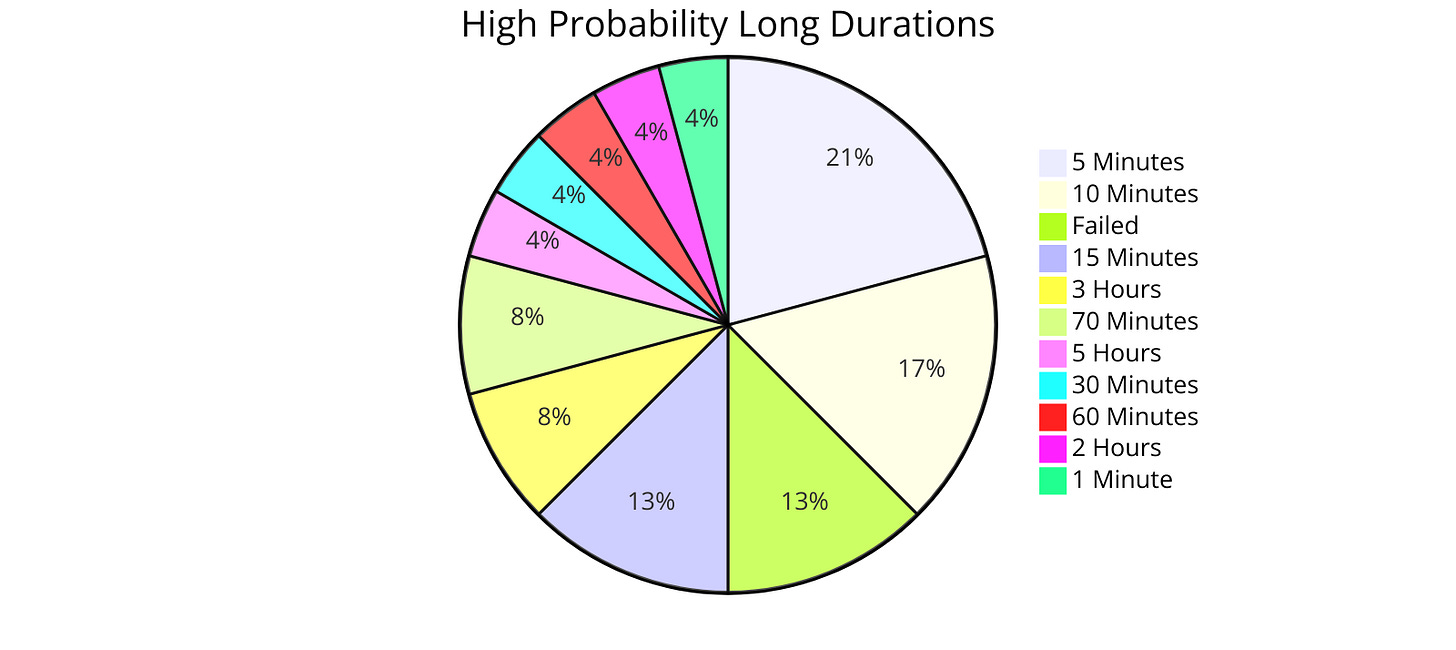

70% will reach target in the first 60 minutes.

TO BLITZ, OR NOT TO BLITZ?

If you’re a TGM subscriber, you’ll know the reasons and some of the strategies we can use to best mitigate the ‘Failed’ alerts.

Let’s assume you choose to ‘Snipe’ these alerts. You would have missed ~65% of the successful trades. For the long alerts, you would have missed ~80% of successful trades.

The flipside to this is obviously that you would have had a much improved (>10pts each trade) Risk / Reward outcomes for the remaining trades, both Success & Failures. But you need to be comfortable in your own head with missing a lot of winners.

There is no ‘Right’ answer here, it depends on many factors such as your risk profile, trading temprament, available free time, goals and so on. Whichever way you choose to trade, as always, Risk Management is paramount. A high confidence trade can still wipe out your account if not managed correctly, as you can see with the failed alerts up until this point, (including a SHORT alert last Friday when the market rallied 70+pts). This is why it’s important to have confirmation / hedging strategies in place (For example - on Friday where the HP Short Alert failed, our Morning Session suggested any break of the first 15 minute candle would dictate direction, which would have placed you LONG on that break and captured ~53pts to close).

As always am interested in hearing all viewpoints. Feel free to leave a comment or shoot me a DM on Twitter.

Cheers

Marto