WHAT MOVES MARKETS

Understanding the Forces that Shape Financial Trends

Economic Data and Central Bank Decisions

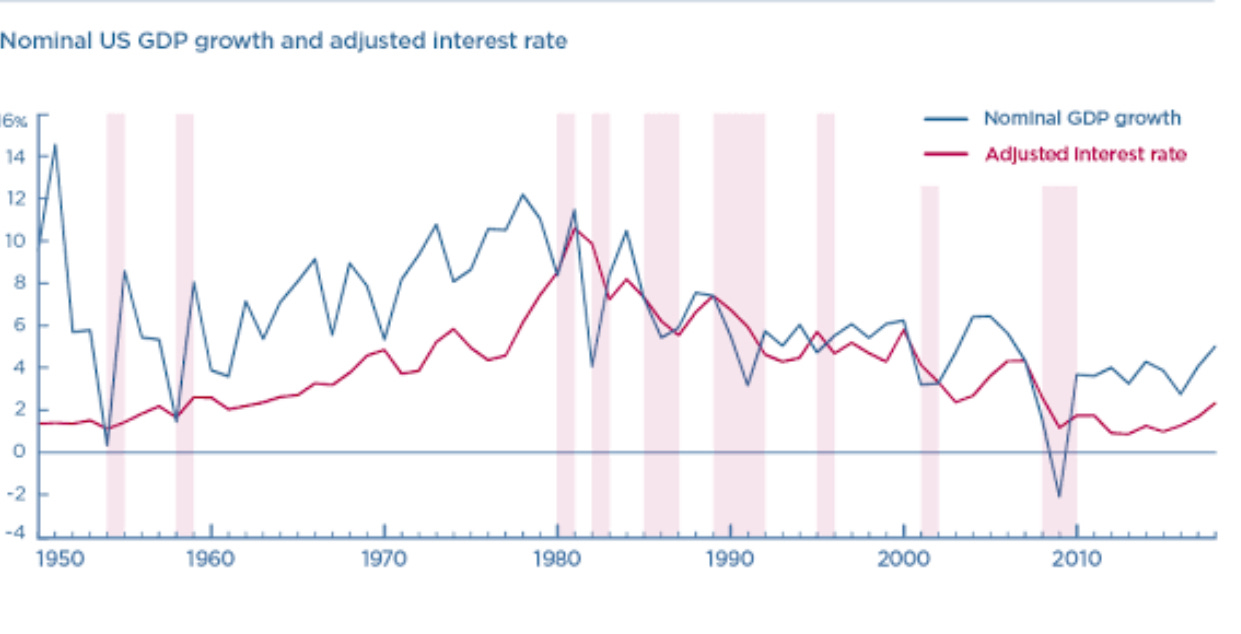

Economic indicators such as Gross Domestic Product (GDP), inflation rates, and employment figures are pivotal in shaping market sentiment. These indicators reflect the health of an economy and can influence investor confidence. For instance, a rise in GDP often signals a strong economy, potentially leading to bullish stock markets, while high inflation rates might indicate economic instability, causing rising interest rate and market jitters.

In my statistical analysis, I attribute about 68% of all LARGE end of day moves to data / policy events. In other words, its worthwhile trading these events if you are a day-trader.

Central bank decisions, especially those related to interest rates and monetary policy, are equally influential. The March 2020 decision by the US Federal Reserve to cut its benchmark interest rate to nearly zero, in response to the COVID-19 pandemic, serves as a prime example. This move aimed to stimulate economic activity during a period of global uncertainty. Its immediate impact was a surge in stock prices as investors anticipated cheaper borrowing costs would fuel corporate growth. The decision also led to a weakening of the US dollar, making exports more competitive but impacting forex markets and dollar-denominated commodities.

Geopolitical Events

Geopolitical tensions, elections, wars, and trade disputes are significant drivers of market volatility. For example, the 2020 US presidential election brought with it uncertainty about future economic policies, leading to fluctuations in the markets. Similarly, ongoing trade tensions between major economies can cause market instability, as traders speculate on potential impacts on global trade flows and corporate earnings.

Natural Disasters and Supply Chain Disruptions

The interconnected nature of global markets means that natural disasters can have far-reaching effects. The 2011 earthquake and tsunami in Japan is a stark reminder of this. The catastrophe caused significant disruptions in global supply chains, particularly in the automotive and technology sectors. This led to a decline in stock prices for companies reliant on these supply chains, underlining the importance of robust and diversified supply networks.

Company Earnings Reports

We have seen over the last few years in particular, how individual company earnings reports are critical market movers, especially for stock prices. The ‘Big 7’ in the US have largely driven the S&P to record highs, while in Australia, the Top 2 companies (BHP & CBA) make up 20% of the index weight. Positive reports can bolster investor confidence, leading to an uptick in the overall market. Conversely, negative reports can cause stock prices to plummet. Tesla's 2021 earnings, which exceeded market expectations, exemplify how positive financial results can lead to a multi-year surge in a company's stock price.

Commodity Prices

Commodity prices, such as those of oil, gold, and silver, are closely watched indicators that can signal changes in market trends, and are particularly important to the Australian market. The oil price crash of 2020, driven by a drop in demand due to the pandemic, highlights the ripple effects across various sectors, particularly energy. This event underscored the vulnerability of markets to sudden shifts in commodity prices and the importance of diversification in investment strategies.

Currency Market Volatility

Foreign exchange markets are particularly sensitive to economic and political news. Events like Brexit in 2016, which led to a sharp decline in the value of the British pound, and the COVID-19 pandemic, which caused widespread volatility in currency values, are potent examples. Understanding these dynamics is crucial for forex traders, as currency movements can have significant implications for international trade and investment flows.

Don’t be a Bear in the Headlights

The best way to ensure that you’re not taken by surprise by major market moves is, of course, to be across upcoming events. Review the upcoming Economic Data releases and major events at the start of every week and put in your calendar (your platform provider should provide these, otherwise there are a range of sites such as myfxbook.com which provide).

It’s also important to keep your finger on the pulse of world events and interpret these through the lens of market consequences. In my opinion ‘X’ is now the best place to get access to any major wordlwide developments, almost instantly.