UNDERSTANDING THE AUS200 PRE-MARKET ALERTS, AND YTD PERFORMANCE REVIEW

I’m overall really happy with the High Probability SMS Alerts which we added back in November, and hopefully these have added value to your trading strategy and P&L as well. Outcomes since we started are shown below.

As background, these alerts were born out of a large trading loss I had in November which didn’t ‘make sense’, from a ‘helicopter’ point of view on what the market ‘should’ have done, so I set about to find out why.

Short-term price action almost always trumps historical parameters or biases in the Short Term. If something has spooked the market, or given it a shot in the arm at open, this will take precedence, especially initially. Hence, I started by backtesting a few variables including the Aus200 opening auction and pre-market moves and found the conditions under which we can make reliable assumptions as to the likely market direction at confidence of >80%.

SHORT HIGH PROBABILITY ALERTS:

So what can we summarise from this:

‘Short’ alerts have a higher probability of failure than ‘Long’ alerts, at around 23%. This makes logical sense in the current market, where the ASX has rallied ~10% in the past few months.

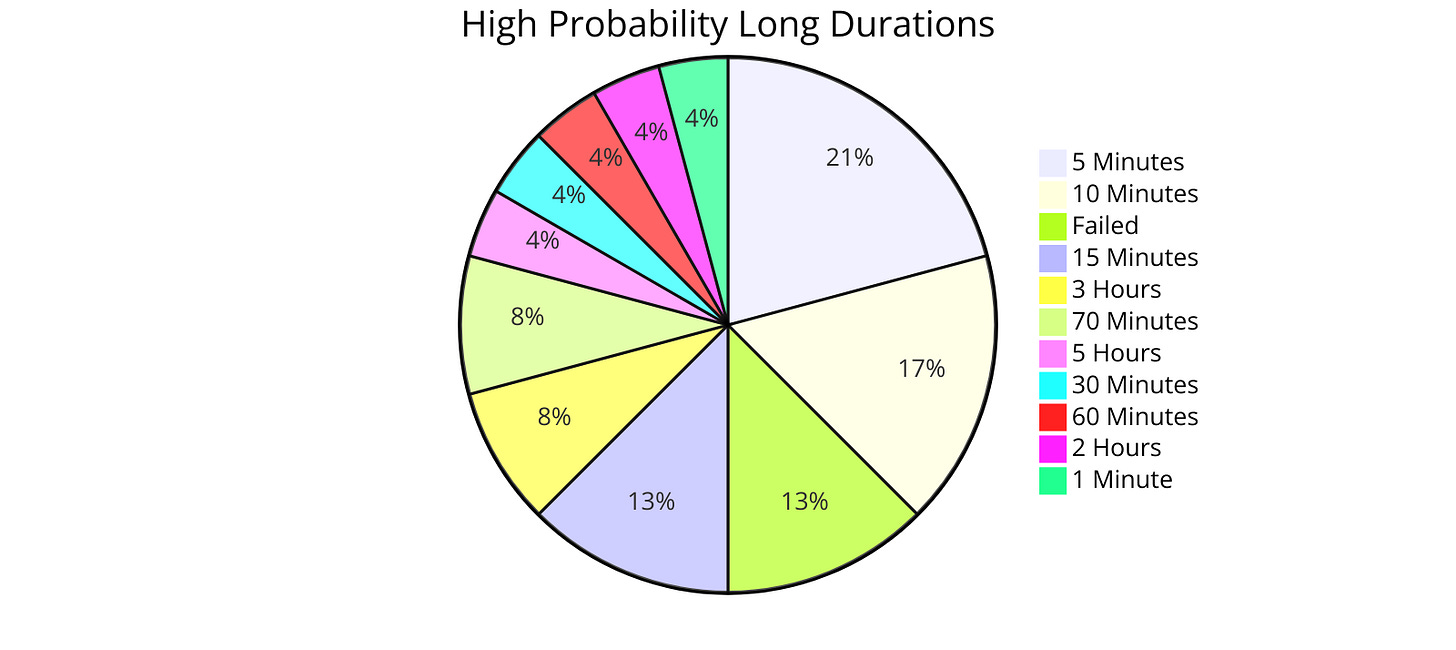

Half of all alerts will reach target in the first 5 minutes of trade. Approximately 60% in the first hour of trade.

So, how best to minimise the losses from failures? This is up to you to determine. However from my pov, stripping out the one Monday outlier where the market rallied 40pts from open before falling significantly (we did flag the chance for this type of move in the Morning Session that day), I would suggest that nearly all the failures could be mitigated by using a 20pts / 11am line in sand, if target has not been reached by that point.

LONG HIGH PROBABILITY ALERTS:

So what can we summarise from this:

Long alerts have a higher probability of success than Short alerts, at 87%.

70% will reach target in the first 60 minutes.

You can see that in 2/3 failures, you actually would have ended with a profit if you had added to your position while the market weakened, and closed the positions at 4pm. Historically it is profitable to add to positions until the target is hit. Looking at the data, I would not be adding further positions on weakness, if the target has already been hit.

Great! We’ve got a somewhat reliable bias given opening price action. So what next?

Unfortunately, there’s no blanket answer. It depends on your personal strategy, risk appetite, leverage/capital base etc etc. Obviously, trading is never black and white otherwise everyone would be doing it. As we’ve seen recently, the overall bias pre-open often looks to be up or down, but the market has other ideas that are flagged at open. How to reconcile these perspectives is where experience and skill come to the for.

You could simply trade at open and look to take 10pts quick profit. You could do the same but take only part profits at target, then at further intervals to ensure you capture large moves, or you could ‘snipe’ these trades - ie. not trade at open and in the event that the market moves against the probable direction early, make a trade with a much-improved Risk/Reward profile. In this case, you will need to be comfortable with missing many of these targets however, with the majority of the setups reaching target early in the session.

Whichever way you choose to trade, as always, Risk Management is paramount. A 90% confidence trade can still wipe out your account if not managed correctly, as you can see with the failed alerts up until this point, including last Friday. This is why it’s important to have confirmation / hedging strategies (eg - on Friday - historically we were looking for any break of first 15 minute candle, which would have placed you LONG on that break and captured ~53pts to close).

What is your strategy if the market moves aggressively in the opposing direction before coming back, or what if it doesn’t? Are you going to add to your position (if so for how long?), or take the loss. You need to be planning for these events well before you place your initial trade, because these moves will happen.

If you look at the outcomes to this point, as a general rule, the LONG alerts are more reliable than the SHORT alerts, with 24th January being the only LONG alert that has failed so far. Per the above, when I backtest through 2023, even the LONG alerts that have FAILED, the majority still make a profit if you had continued to add positions as the market moves against you.

Always happy to discuss further. Feel free to leave a comment or book in a monthly calendly call to dive in further.

Cheers

Marto