HONEY, I BLEW UP OUR BANK ACCOUNT - PART DEUX

HOW DID I SURVIVE AND TRADING BETTER THAN EVER

Thank you for all the feedback on my previous post. Sounds like it hit a chord with many people and has opened a few newer traders eyes to the dangers of leveraged CFD trading, which was my primary intention.

Next step, as my friend and fellow substacker

rightly pointed out, is to reflect on any learnings from this abomination and share, so as to hopefully provide value to others.So what did I change / learn out of this:

This will sound ridiculous (I have been trading 20+ years, I should have known better), but it gave me a better understanding and appreciation of the role of leverage, position sizing, and dangers of hubris. Failure to properly manage these can literally ruin your life.

An even greater commitment and dedication to refining my day-trading edge. I made a promise to myself that a) I never wanted to be in a position of complete ‘uncertainty’ again, and b) I would increase my efforts to develop a system whereby I would never have an excuse for missing a large single-day move again.

As of that moment I retired my discretionary swing trading / long term holding strategies, and I now leave the long term heavy lifting to my super balance, which is 100% in index linked ETF’s. I keep a ‘Net Asset’ spreadsheet and my weekly update (which includes account balances, cash, angel investments, and my super balance) gives me solace that I’m not missing out on large rallies like those we’ve had over recent history. My entire discretionary day-trading strategy is centred around identifying the precursors to large-scale market moves both up and down, (which can be identified in the data), and trading for those moves with the tightest possible risk management frameowrk, developed based on similar historical moves. In other words, I see my trading strategy like taking out low cost ‘option contracts’ (ie stopping out 3 times in a row for a 10pts loss) so that I always participate in market mvoes that are worthy of my time and effort.

The next year was spent building, cleaning and refining the data set until I was confident that the data was a) reliable, b) measuring the correct data points to make actionable trading decisions, and c) that the set was to a large enough scale to ensure adequate sample size and so increase the statistical power of the model. It’s currently sitting at around 32,000 cells of data (all entered by hand). This raw data then feeds into another speadsheet which gives me output on 69 different ‘questions’ I can ask relating to the AUS200, 19 on the UK100, and 50 for the SPX500.

Having the data is one thing, that’s easy (especially if you’re tech-savy), but extracting actionable insights from it is quite something else. What time periods are important? What pre-cursers determine whether we get large ranges, or likely to be chopped up by indecision? Do Gaps fill? Do flows cross borders? If so, do they cross from SPX to AUS, or from AUS to SPX? Unfortunately for most traders, in my opinion, years of experience watching and trading markets (or finding a mentor with experience) is the only way to achieve these learnings.

Once you head down the rabbit hole of quantitative analysis of the markets, it’s difficult to stop. There are so many consistent market inefficiencies across global indexes, the most difficult past in my trading at the moment is what high probability trades not to take. Did you know that the direction of large moves (excluding Data / Event driven days) in the S&P can be forecasted to ~95% accuracy 8 hours before their market opens? That’s clear from the data. Or that the FTSE rallies in the hour leading into it’s open 100% of the time given a bullish lead? That’s clear from the data. Monday morning exhuberance when the Aus200 re-opens after the weekend? We finish lower 100% of the time. That’s clear from the data. Very powerful.

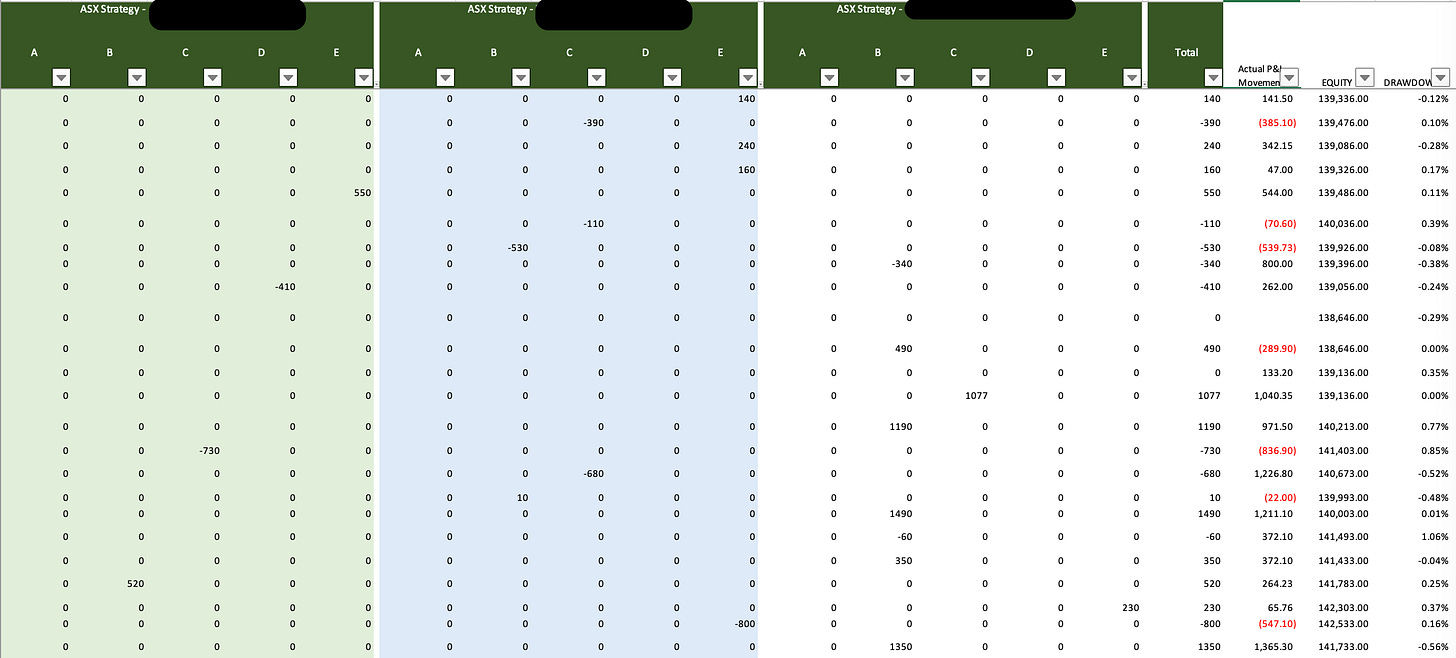

I now quarantine different strategies into separate CFD accounts, which I trade and monitor independently. For example, amongst others, I have an account for my discretionary day-trading, a corporate trading strategy which I developed and trade on behalf of a High Net Worth client, and an account which trades purely based on the High Probability SMS Alerts which I send out to my TGM substack subscribers. The foundation for all of these strategies are the data, but each exploit different market inefficiencies. This way I can isolate and easily track, and adjust my strategies as needed. The drawback for this is that I forgo the rebates which are offered by my brokers, which can be sizable.

Dicipline = Freedom. To a) keep the trading of these strategies consistent and ensure I don't f*ck it up ( eg. for the above strategy I was in transit when the only loss occurred with no risk management in place🤨), and b) allow me to travel full time without needing to be permanently in front of a screen; I've also now outsourced the trading of some of these strategies to an independent party, providing clear, concise rules as to how to trade these accounts. Obviously there are risks to this, and again, if you’re tech savvy, am sure you can develop and program code to carry this out automatically.

I make sure the strategies are measured dynamically, not just theoretically backtested. This is one of the biggest mistake I think newer traders make. I manually input the end of day profit outcomes for all of my strategies into our spreadsheet, into the cell right next door to the expected profit outcomes. Any differences are highlighted, investigated, and required to be explained.

I also learnt basic code, and with the help of ChatGPT, my directional trading decisions for each of these strategies and the corresponding rules for Additional Entries, Take Profit levels, and Stop Loss levels are input in real time, and now completely automated daily before ASX open, so that it’s difficult for me stuff the trades up.

This is a super-easy way for any traders who are not overly tech-savvy to use some powerful tools to increase trading dicipline. For example; Only want to trade days where there’s a) some kind of market moving data release, AND b) a volatile pre-market move? Get chat GPT to write conditional code and export it to Visual Studio Code etc, which prompts the question before market open. Input an outcome so that if you answer ‘No’ and ‘No’, you get an answer like “Go Surfing Dickhead. No Trade Today”, or similar.

So while I am still a loooooooong way from where I would like to be as a trader, I feel like the cataclysmic event I endured in 2021 forced my hand to become more focussed and diciplined on what steps I needed to take to ensure that I found my own unique trading ‘style’, in the future.

I have not felt any ‘uncertainty’ entering a trade for probably 18 months using this strategy; I know the potential outcomes when I enter a trade and invariably several of those possible outcomes involves capital loss. But I’m confident that I’m making the best possible decision, based on the available information. It’s very robotic.

I often get asked ‘so how did you trade for the 20 years before?’, and I can honestly say that I don’t remember. Just pure gut with a sprinkling of hunches and Technical Analysis I guess. Doesn’t seem very clever in hindsight, and I definitely didn’t have any ‘Edge’. In fact that’s the only thing I really miss about my pre-2021 blowup style…the adrenaline rush from not knowing whether I’ll be up or down $20k by end of day!

But I guess it’s a price worth paying for peace of mind in this insane, chaotic business we call day-trading.

As always, any questions feel free to reach out.

Cheers

Marto

Now.We.Talking!!! This is a simply brilliant post and so pleased you tackled the questions highlighted. It takes genuine reflection and perseverance to have done what you have in the face of such adversity. Love your new structure that works for you. "Now go surfing" hahah