HONEY, I BLEW UP OUR BANK ACCOUNT

From Cloud Nine to Subprime: My Leverage Love Story

I owe my current lifestyle to hard work and trading off the back of that, but before we look at all the incredible advantages and opportunities presented by CFD trading, let’s take a look at what can go wrong.

27th January 2022. Commemoration Day for the Victims of National Socialism. Also one of the worst days of my life.

Wake up. Check phone. Notifications. Messages. Emails. Lots of words like ‘Margin Call’ and ‘Liquidation’. Fuck.

I’m sure a lot of traders have a similar story.

I’d had a steller run, day-trading through the COVID madness, earning more in 2020 than I’d ever earned working in the Corporate world, or ever took out of our family business over the previous 5 years.

On top of these Super Profits I had wisely gone ‘LONG’ or ‘Bought’ the Aus 200 Cash CFD (which effectively tracks the ASX returns) through the depths of the COVID lows and put them in the ‘bottom draw’. As we now know, the market rallied 80%+ over the next 2 years.

By the end of 2021 I was newly settled on the Gold Coast overlooking Palm Beach, and sitting pretty. The first day of January 2022 our market rallied hard and hit new highs.

Over the next month it dropped 12%, or ~1000pts. I took the Warren Buffet approach, topping up heavily as the market fell. It’s like buying the same companies on sale, right??

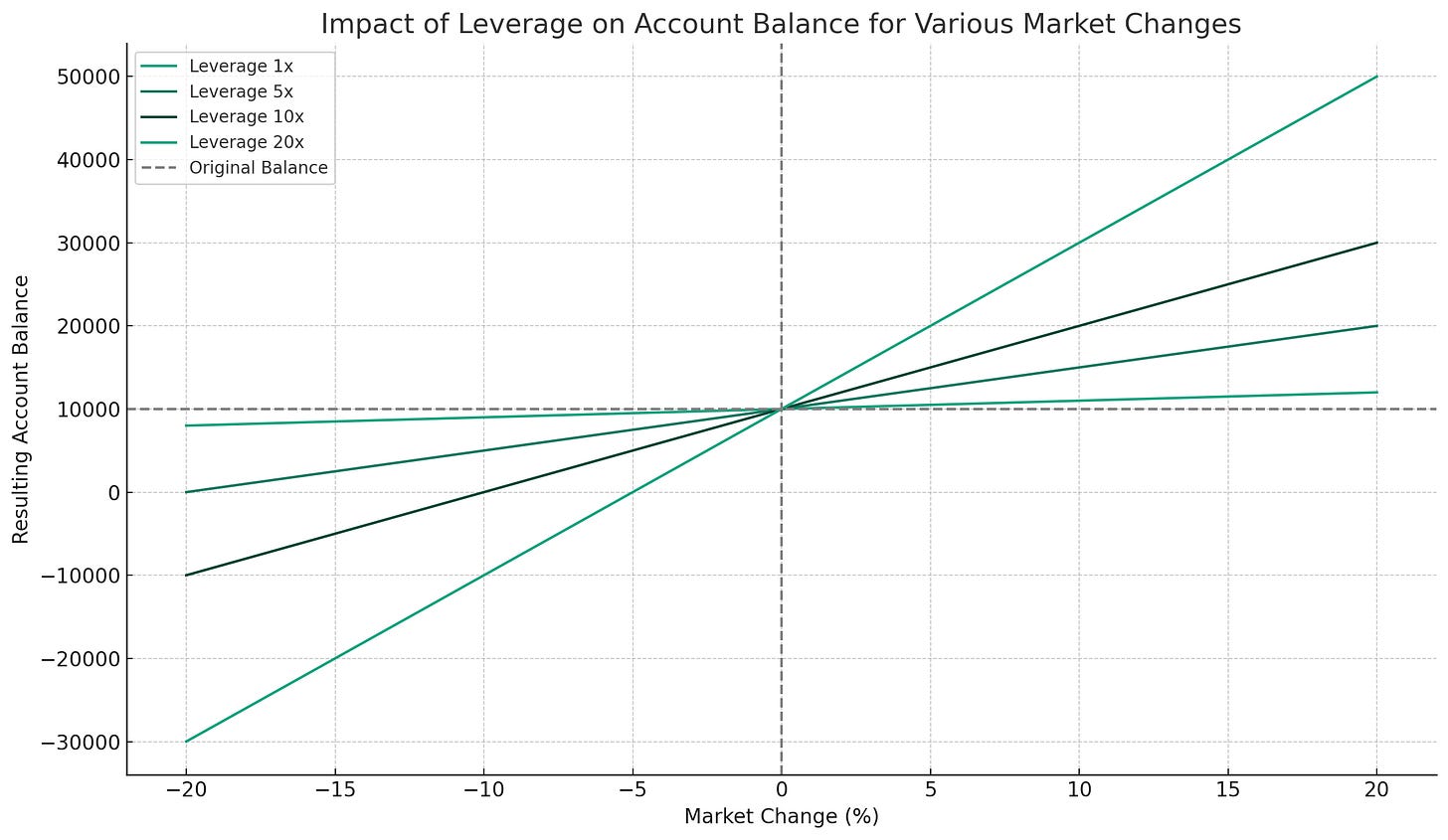

Unfortunately what make CFD’s so incredible for wealth generation is also their largest risk factor. Leverage. I was holding more than 700 contracts (about $5m worth), and so losing $700 per point that the market fell. Due to the ‘Leverage’ factor which we will discuss at a later date, I only had to pony up ~$10,000 initially to cover the margin on $5m worth of contracts. That was wiped out in minutes as the market fell.

January 24th the American market tanked 80pts intra-day, and the Aus200 fell significantly more, down 300pts during the night. I still had ~$100,000 equity in my account, however the calculation that my CFD provider used to workout the ideal time to liquidate accounts, magically liquidated me at 6762 at 3:13am in the morning, within points of the EXACT low of a 300pts overnight fall. My net worth had dropped $500,000 in less than a month (a significant portion of my overall worth), and I had taken a $250,000 net loss. The market rallied over the next 3 months back to touch all time highs, which I watched in disgust.

Cool story huh? Make no mistake, CFDs can be extremely fucking risky if you don’t know what you’re doing, don’t have in place proper risk management, or let hubris get the best of you.

The upside of this experience was significant. As I’ve said before, personally I feel the most ‘alive’ after big losses. I’m excited because I know I’ll sharpen up my Risk Management rules further, and never make that mistake again. I’ve rebuilt my capital from that trade and more. Obviously having the TGM Insights data set helps now, but I can’t remember the last time I took a large trading loss. It just doesn’t happen to me anymore.

In March 2021, ASIC did introduce new regulations to protect retail traders, the main changes being:

- Margin rates increased across all asset classes

- Total losses on CFD positions will not exceed funding in the associated trading account

- Prohibition of certain benefits to traders

- Margin close out ratios

If you can satisfy certain criteria around trading experience and / or net worth, you are able to be classified as a ‘Sophisticated Investor’ or a ‘Pro’, and while this does afford you some benefits in terms of increased leverage (I get between 250:1 / 500:1 depending on broker), a dedicated account manager, rebates and tickets to footy games, you also LOSE the above protections afforded to retail traders.

So while CFD trading offers of host of advantages over traditional trading, it also comes with some big risks that traders need to be aware of. Consider these carefully before trading, or making the decision to upgrade your account.

As always, any questions feel free to reach out.

Marto