FIXED SPREADS: WHAT DO THEY MEAN?

Important Consideration, or a Broker Fugazi?

In Day Trading, properly understanding the various cost structures of different brokers is crucial to accurately forecasting and protecting your P&L. Given the amount of executions and turnover you’re likely to trade, Spread Costs, Overnight Finance rates and Commissions can have a material impact. For me, it’s often a $100,000+ expense per year, so I need to make sure I’m across it. Like the late great KP once said;

“I am not evading

taxbrokerage and spreads in any way, shape or form. Now of course I am minimising mytaxspreads and if anybody in this country doesn't minimise theirtaxspreads then they want their heads read because as agovernmentbroker, I can tell you you're not spending it that well that we should be donating extra”Kerry Francis Bullemore Packer

One concept that often comes up is the "Fixed Spread." This has become particularly important to me over time, as a chunk of my ongoing profits come from trading what I would call ‘Special Event’s’, such as CPI, FOMC etc, where I’ve witnesses spreads from several brokers blow out during these periods, severely impacting my edge.

So let’s look at what a fixed spread is, why it might be beneficial, and how it compares to variable spreads in CFD trading.

What is a Fixed Spread?

A spread is the difference between the bid price (the price at which you can sell) and the ask price (the price at which you can buy) of a financial instrument.

Contrary to popular belief that Brokers’ are just ‘ripping you off’ by conspiring and betting against your positions, in my experience most reputable brokers hedge out the vast majority of exposure they have on both the long / short side, and the “Spread” is where they actually make all their money. Our minuscule trading positions don’t really keep them up at night. In fact, they have an incentive for you to succeed!

Successful traders = much larger spread income over a far longer period, VS novice traders who blow themselves up, providing minimal income and attracting the attention of ASIC.

In CFD trading, brokers offer different types of spreads to their clients: fixed and variable.

A fixed spread means that the difference between the bid and ask prices remains constant, regardless of market conditions. For instance, if a broker offers a fixed spread of 2 pips on the EUR/USD currency pair, this spread will remain the same whether the market is calm or highly volatile.

How Fixed Spreads Work

When trading CFDs with a fixed spread broker, the cost of entering and exiting a trade is predetermined and does not change based on market volatility or liquidity. This predictability can be advantageous, particularly for traders who need certainty in their trading costs.

For example, if you're trading the GBP/USD pair and the broker offers a fixed spread of 3 pips, you'll always know that your transaction cost for entering and exiting a trade will be 3 pips, no matter what happens in the market. If it’s variable, then the broker may widen the spread considerably during times of volatility to compensate them for the risk.

Benefits of Using Fixed Spread Brokers

Cost Predictability The primary advantage of fixed spreads is cost predictability. Traders always know the exact cost of their trades, which helps in budgeting and planning. This is particularly useful for traders with tight margins or those who need to manage their trading costs precisely.

Easier Risk Management Fixed spreads simplify risk management. Since the trading cost remains constant, traders can more accurately calculate their potential profits and losses. This predictability aids in developing more effective trading strategies and managing risk more efficiently.

Stability During Volatility In volatile markets, variable spreads can widen significantly, increasing trading costs. Fixed spreads provide stability in such conditions, ensuring that traders are not adversely affected by sudden spikes in spreads due to market events or low liquidity.

Transparency Fixed spread brokers offer a transparent pricing model. Traders are always aware of the costs upfront, without worrying about hidden fees or sudden changes in spread due to market conditions.

Beginner-Friendly For novice traders, fixed spreads can be easier to understand and manage. The simplicity of knowing the exact transaction cost helps new traders focus on learning market dynamics and developing their trading strategies without the added complexity of fluctuating spreads.

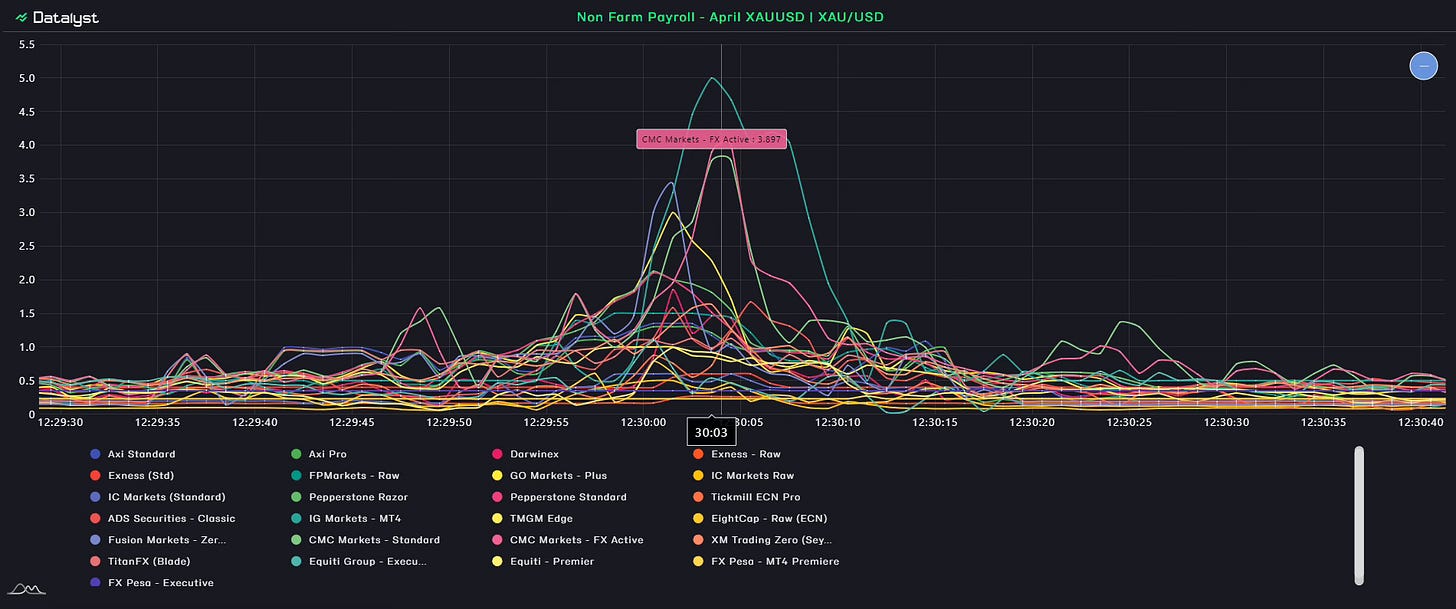

Consider some spread data on the US Non Farm Payroll (NFP) release for the two largest CFD brokers in Australia, CMC & IG Markets. You can see that in order to protect themselves from the inherent volatility around the release, they widen spreads significantly. I also am told that one of these players still manages their spreads and exposures around these releases manually, which is a concern to me😳

Comparing Fixed Spreads to Variable Spreads

While fixed spreads offer several advantages, it's important to understand how they compare to variable spreads to make an informed choice.

Variable Spreads Variable spreads fluctuate based on market conditions, such as volatility and liquidity. During periods of high liquidity and low volatility, variable spreads can be narrower than fixed spreads, potentially offering lower trading costs. However, during periods of high volatility or low liquidity, variable spreads can widen significantly, increasing trading costs.

Cost Implications Fixed spreads might be slightly higher on average compared to the narrowest variable spreads during stable market conditions. However, the predictability of fixed spreads can offset this by providing stable costs during volatile periods.

Broker Considerations Brokers offering fixed spreads may do so to appeal to traders seeking stability and predictability. However, it’s important to choose a reputable broker with a robust execution model to ensure that the fixed spreads are honored, especially during extreme market conditions.

Practical Considerations When Choosing Fixed Spread Brokers

Broker Reputation Always choose a reputable broker known for honoring their fixed spread commitments. Check for regulatory status, client reviews, and the broker’s history in maintaining spreads during various market conditions.

Trading Conditions Review the trading conditions offered by the broker, including the range of instruments available, leverage options, and other trading costs. Ensure that the overall trading environment aligns with your trading strategy and goals.

Platform and Tools The trading platform and tools provided by the broker play a crucial role in your trading experience. Look for brokers offering robust, user-friendly platforms with advanced charting tools, risk management features, and educational resources.

Customer Support Reliable customer support is essential, especially when trading with fixed spreads. Ensure that the broker provides timely and effective support to address any issues that may arise during your trading activities.

Conclusion

In my experience….fixed spreads don’t matter, until they do.

A quick search for Australian Brokers who offer fixed spreads returns options like TradeDirect365, Easy Markets, ATFX, FXCM, and Trade Nation (who is my preferred broker).

These guys are excellent humans, and have been extremely supportive of what I’m trying to achieve via this Substack with improving the education and overall outcomes of Day Traders through using statistics, and a probabilistic approach. They also offer fixed spreads, including 0.8pts during market hours, and 2pts outside market hours for the Australia 200 Cash product, and 0.5pts for the US500 product.

For September, they’ve also been good enough to offer to pay for a complementary month of my daily editions of the Morning & Evening Sessions Substack ($195 / month), if you’re a SI and willing to try them out and signup here.

As always, any questions please feel free to reach out.

Cheers

Marto

TGM TESTIMONIALS

What our Premium Subs are saying.