Trading Plans…should you bother with them (if so, how comprehensive should they be?), or just follow the price action with no pre-conceived bias?

Ask any experienced (non-algorithmic) Day Trader, and they will likely mention preparing their trading plan as an integral part of their daily routine. That’s not a fluke.

“ If you are Failing to Plan, you are Planning to Fail.”

Benjamin Franklin

In my opinion a defined Trading Plan and the corresponding review of said plan helps you develop your thoughts, brings to the surface any weaknesses/inconsistencies in your execution, and generally just improves your overall trading discipline.

My process is certainly not the only, or the best that you’ll find around the traps, but it may give you some ideas or perspective on how to develop a process that works for you.

1. Review prior day / overnight moves

First thing I do when I wake up (when I’m in AUS) is to look at what has driven markets overnight (SPX) and review the moves in the Australian market the prior day.

I input relevant prior day data into my spreadsheet, screenshot the charts of the markets which I traded, and make notes on those charts as to what went right / wrong with those trades, and learnings for next time. This usually includes several expletives about what an absolute rubbish trader I am and the mistakes I made🤬 (as an aside, I think this ‘perfectionist’ type of mindset is something that many traders struggle with on an ongoing basis. I certainly do).

I know many people use Edgewonk, Evernote, or other platforms to journal trades also, which are worth a look. My review is quite simple by some standards.

One of the guys I work with - works a 10 hour day, wakes up in the middle of the night for a Zoom with me to clarify / stress test strategy, trades the SPX open, then heads back to bed for a couple of hours before doing it all again. That’s dedication and is now starting to pay off; recently hitting his initial (well defined) goal of achieving a ‘Certificate of Funding’ from a Prop Firm by hitting their required profit target. One of his Daily Reviews below, which I would consider this to be close to ‘best practice’.

2. Are there any Major Drivers for the market today?

Next I’ll think about any events which could potentially move markets significantly for that day. In my case, I keep track of the largest ~100 historical futures moves on each of the major markets (AUS200, SPX, UK100) over the past few years, and what events / data releases / prior moves were responsible for those large rallies or crashes. Note that this is particular to my trading style, which someone once described as ‘We’re not here to f*ck spiders’, ie - I’m not scalp trading, I’m focusing on ensuring I capture large market moves either higher, or lower. I would sugges that this means my win rate is lower than most.

The list of key drivers is fairly short (about 10 - CPI, Large Futures Dislocations, etc), and if one of them ain’t present that day, I reduce my position sizing and increase my trading discipline significantly (ie I’ll be much more patient awaiting a proper R/R landscape, given the most likely outcome is passive moves or chop). I then complete and send out my Morning Session substack based on the historically relevant data to provide some edge.

3. Write out an initial plan

Based on the above, I’ll write out an initial plan for the day. Most of the time it will include something like ‘LONG positions only!!!’, if the historical data is strongly pointing in one direction. This is of course only an educated guess and I’m happy to be proved wrong on the times that the market moves strongly against what it’s done in the past, but the main thing I’m trying to avoid is getting caught up in emotional trading; flip-flopping and churning up my capital. I’m flexible if something significant changes on open (ie an adverse directional High Probability alert, or a material initial move), but this is my guiding light.

I’ll consider what history tells me in relation to;

Likely XJO end of day moves: Are futures currently underpricing the market when compared to historical XJO moves? Eg if J Powell has just ‘cut ze rates’ and the US market has mooned 100pts, what are the historical finishes for the XJO? If all past XJO closes have been between 50-100pts, and our futures are pricing in +150pts at open, it’s possible that we’re overpriced and SHORT positions would be the highest probability trade.

Likely futures moves: What happens historically when the overnight futures are pricing a 50pts fall on open, when the XJO rallied yesterday? Do the market participants usually underprice, or overprice in these situations? If it often underprices, a LONG would be a solid plan.

Likely Regular Trading Hours moves: Similar to the above (but quarantining XJO moves ie stripping out opening gap / premarket moves on the AUS200) how does the XJO react under different circumstances? Does the market normally adjust quickly from open, or chop / consolidate for some time before making a move?

Based on similar day historical ranges, I’ll draw the likely minimum, and average daily ranges, which act as my guiding light for Take Profit targets.

4. Watch the Open

The opening gap / price auction and subsequent pre-market positioning for the AUS200 (9:50am-10am) gives us another piece of the puzzle in developing a theory on the likely ‘shape’ for the day. Same can be said for the hour before UK100 / SPX500 open.

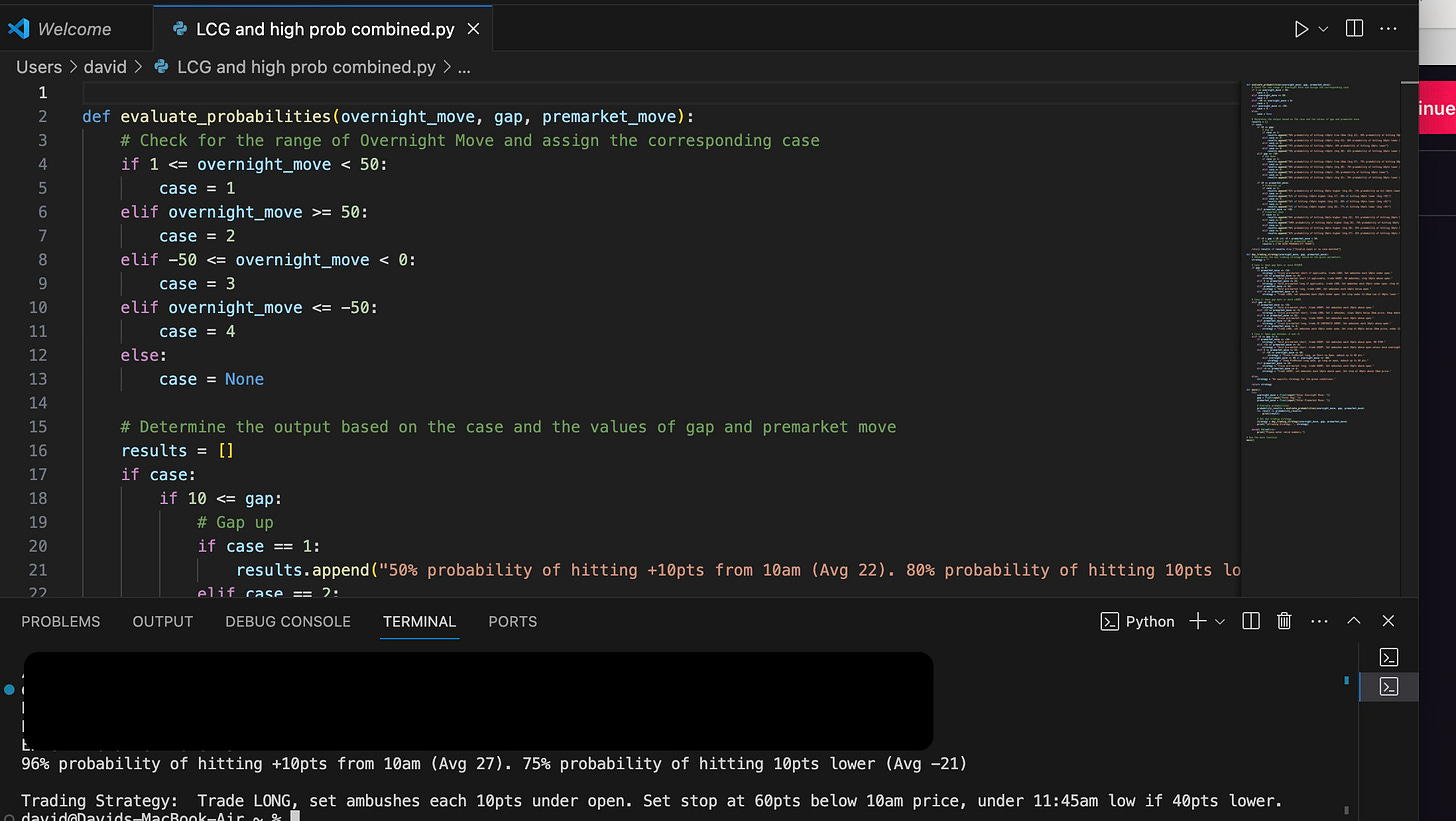

At this point I input various conditions into a code I use (with the help of ChatGPT) which produces probability parameters and also trading orders I need to execute on an agreed strategy which I trade on behalf of a HNW client.

High overall conviction to the upside, however an opening move that produces a SHORT High Probability Alert and thus has a high incidence of downside? This would cause me to pause, and adjust my strategy, given it’s highly likely that we will get a move both ways at some point during the day.

Short daily bias, combined with a short indicator on open? Increase position sizing on my open short positions. Early price action / indicators from Open & Pre-market almost always trump the overarching daily bias for the first 30 minutes. This is also the point where I send out any High Probability setup alerts.

I note down my SL levels based on the most likely ‘shape’ of the day (based either on historical point moves, or historical times of day lows / highs given setup), and TP levels around minimum, and average historical moves to day high / low.

5. Lurk in the Shadows

I’ll try then to stay out of adjusting / adding / reducing positions until 10:15am. By this time all individual stocks are trading freely, and we have a clear picture of what the overall market looks like. The initial move in these 15 minutes will generally cause me to add, or reduce my positions. If my theses is LONG, and i’m expecting a large move, a fall for this period will result in me closing my positions, and vice-versa. No questions asked. There simply is no reason to be long in that circumstance, statistically. Hope is not a strategy.

I’ll do the same after the first hour. Filter through similar past setups, if those outcomes don’t line up with my thesis - I’ll cut positions, if they support - I’ll add to them. This is even more critical to me currently, given my location in Europe. I give myself a strict timeline of 2-3am to get my positioning, sizing, SL’s & TP’s set so I can head to bed. Everything you need to know about the day is known within the first hour or trade, imo.

6. Settle Up

All positions closed at 4pm, daily. If I’ve got an edge trading the overnight move, I’ll simultaneously close and open a new position, even if it’s in the same direction. I’m happy to cop the spread costs. For me, they need to be quarantined as separate trades, given they have separate parameters and probabilities.

As always, reach out if you have any questions.

Cheers

Marto

Great write up Marto, just what I needed to read right now. Thanks!