AUSTRALIA 200 MARKET RECAP AND GLOBAL MARKET PREVIEW

April 8th - 12th, 2024

By request, this is an abridged cut and paste from the Morning and Evening Session Substacks for the week 2nd-5th April, excluding the premium daily data sets. As always, please feel free to unsubscribe from any of my ramblings here.

AUS200 WEEKLY RECAP 2ND-5TH APRIL

Open: 7881

High: 7917

Low: 7740

Close: 7806

Change: pts (-0.96%)

Tuesday 2nd April 2024

Should get some significant moves first hour, potential to straddle the open to capture any exaggerated moves. RTH moves are skewed to the upside, 80% historical occurrance of a >20pts move from 10am open to intra-day high.

HP Long Successful. 34pts to day high.

Large gap down and pre-market fall was unexpected, however this setup gives us a 100% historical occurrence of a >10pts move higher, intra day. Overlaying this on early falls, one interpretation is that you had a 100% past success rate of making >26pts if you traded long from early lows.

Wednesday 3rd April 2024

Potential futures moves higher are typically capped at ~20pts under this setup, with a reasonable tail to the downside.

HP Short Successful. 80pts to day low.

If you look at dataset from yesterday, ~80% of finishes were <+6pts or less. With open auction gap up of 8pts you could effectively have made a short trade with a 80% historical probability of success at this point. Never really went above XJO open.

Thursday 4th April 2024

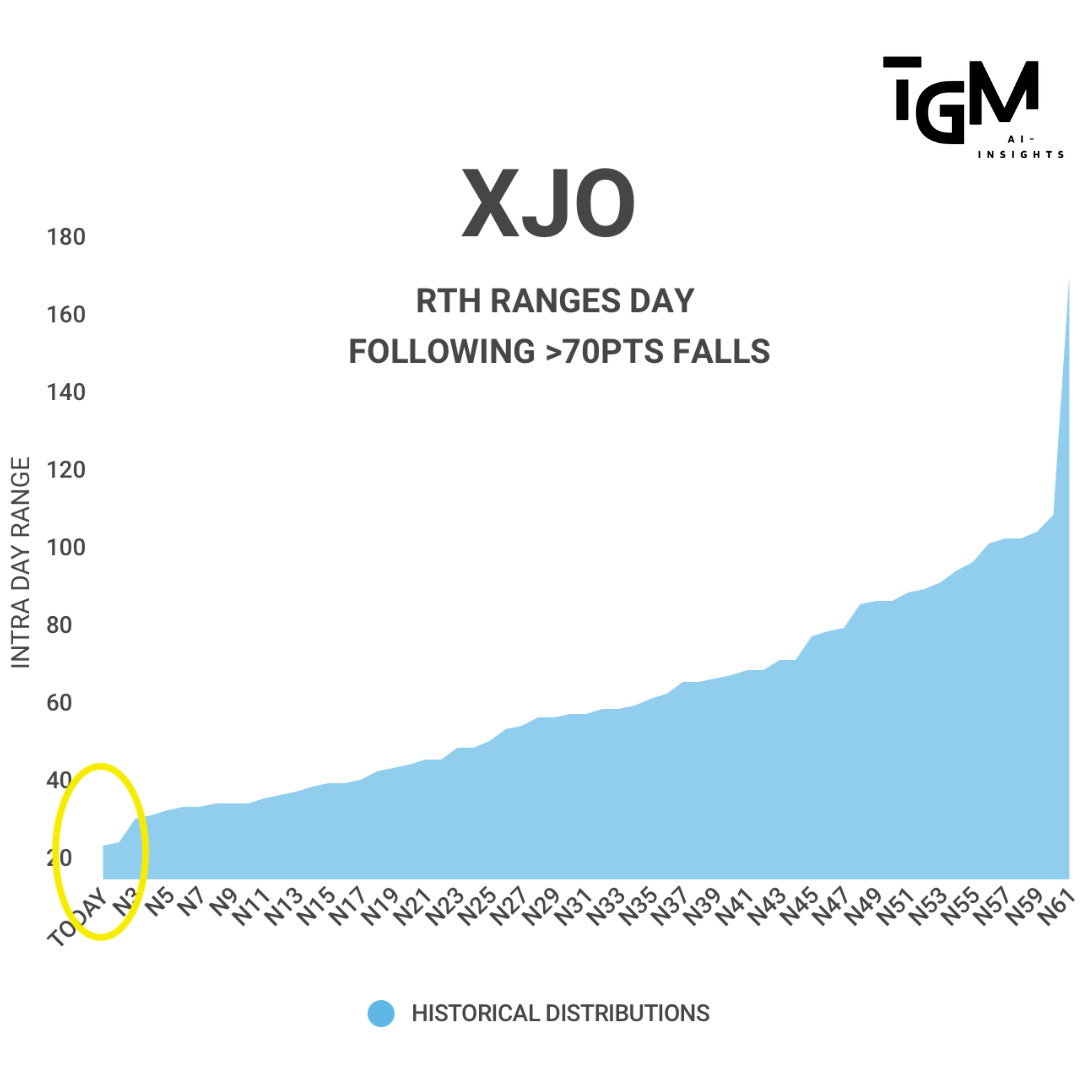

More green than red historically following a selloff like yesterday, however only sure thing from that data is that we should get a decent, 40+ range. 20pts either side of open should act as the LIS for any large directional moves.

HP Long Successful. 17pts to day high.

Frustratingly small range following Wednesday’s falls.

Friday 5th April 2024

Almost certain to get a wild Gap / Pre-market, followed by a 40+ range today, average 75pts. Usual story for days like this, any ground shattering RTH moves should move from open with <10pts to day high / low. 80% probability of >15pts intra-day falls, 60% of >15pts intra-day rally.

HP Short Successful. 12pts to day low.

Got the >40pts range expected. Few contra-indicators with HP Short, early lows >4pts, then break of first 15 minutes high and positive first hour move. Usually suggests we finish not far from where we start.

NOTABLE MENTIONS - GLOBAL

Day coming after a long weekend went as expected, and then lots of reasons were given for the 100+pts selloff on the SPX Thursday; Iran, Russia, Oil, Gold, Fed Speak. Probably a combination of all of these, however one that wasn’t mentioned was a delayed response to J Pow’s speech given the day before. The man has been responsible for seven 100+pts falls outside of FOMC meets over the past four years when he opens his mouth.

I have been doing much detailed analysis on quantitative driven strategies around the major US data releases over the past week, and NFP moves were as expected. Will share these with TGM subscibers over the coming week.

GLOBAL MARKETS PREVIEW WEEK BEGINNING 8TH APRIL

AUSTRALIA 200

N/A

UK100 / EUROPE

ECB Interest Rate Announcement Thursday @ 10:15pm. Historically bullish for equities. Rare to see any material falls.

UK GDP on Friday @ 4pm AEST. Usually can count on a decent first session range.

S&P 500

CPI Wednesday @ 10:30pm AEST. Average range 93pts. Trading LONG on Monday morning before each CPI over the past 18 months would have returned ~1000pts of profit. Followed by Fed minutes @ 4am AEST.

PPI on Thursday at 10:30pm AEST. Futures rally into announcement more than 75% of the time, however if they don’t, it's usually brutal.

Have a good week.

Cheers

Marto