AUSTRALIA 200 MARKET RECAP AND GLOBAL MARKET PREVIEW

May 6th - 10th, 2024

By request, this is an abridged cut and paste from the Morning and Evening Session Substacks for the week 29th April - 3rd May, excluding the premium daily data sets.

My aim with distributing this is to improve the education level and risk management skills of traders at all levels of experience. As always, please feel free to reach out to me, or unsubscribe from any of my ramblings here.

AUS200 WEEKLY RECAP 29TH APRIL - 3RD MAY, 2024

Open: 7611

High: 7677

Low: 7526

Close: 7658

Change: +47pts (+0.62%)

Monday 29th April 2024

Premarket Analysis:

85% of days finish the day single digits or lower 10am-4pm as we await major market re-openings.

Postmarket Wrap:

HP Long & HP Short alerts both successful.

Finished single digits higher from 10am. Early spike gave good opportunity to look short, given historical probability of move lower and likely first hour top.

Tuesday 30th April 2024

Premarket Analysis:

End of Month. Would suggest to keep an eye on break of early ranges for likely direction. These days tend to continue their direction and hit day lows / highs quite late in the day.

Postmarket Wrap:

Early drop and bounce off pre-10:15 lows and break of new highs was rare, but bullish. Rallied into close to day highs as suggested yesterday.

Wednesday 1st May 2024

Premarket Analysis:

Scheduled to open ~88pts lower. Usual shape is lower with minimal moves to day highs, from 10am open, see dataset.

Postmarket Wrap:

Got the falls expected from open, however more muted than expected, historically given overnight moves. Break of early highs suggested some value in longs, given the high probability of additional range expansion.

Thursday 2nd May 2024

Premarket Analysis:

Per dataset, we usually break one way from open, single digit moves to high / lows 84% of the time.

Postmarket Wrap:

HP Short failed. 7pts to Day Low. First failed HP trade in the last 18, so we were well and truly due.

Per the dataset, we were highly likely to see a single digit move only, one way or the other. Once the market rallied to 10+pts in the second minute of trade, LONG was the bias of the day, with targets set around minimum-average range of day ~40pts+.

Friday 3rd May 2024

Premarket Analysis:

Compelling case for higher than lower, heading into Friday. 88% historical occurence of closing flat / higher.

Postmarket Wrap:

Short HP Alert successful. 11pts to Day Low.

The data provided could not have mapped out the shape of the day much better. Short alert at open, combined with a high probability of finishing in the green.

NOTABLE MENTIONS - GLOBAL MARKETS

SPX had its 3rd largest End of Month fall in our dataset on Tuesday, and the largest fall heading into FOMC, falling 91pts to close out April. This was followed by a move of exactly 0pts, to begin May. FOMC market rally largely telegraphed prior to 70pts rally…the subsequent 70pts fall unusual.

FTSE had an interesting week, with traders consistently underpricing the physical open. Futures moved higher from open 4 out of the 5 trading days.

GLOBAL MARKETS PREVIEW WEEK BEGINNING 6TH MAY

AUSTRALIA 200

RBA Tuesday. Specific days for the AUS200 leading into, and out of the announcement.

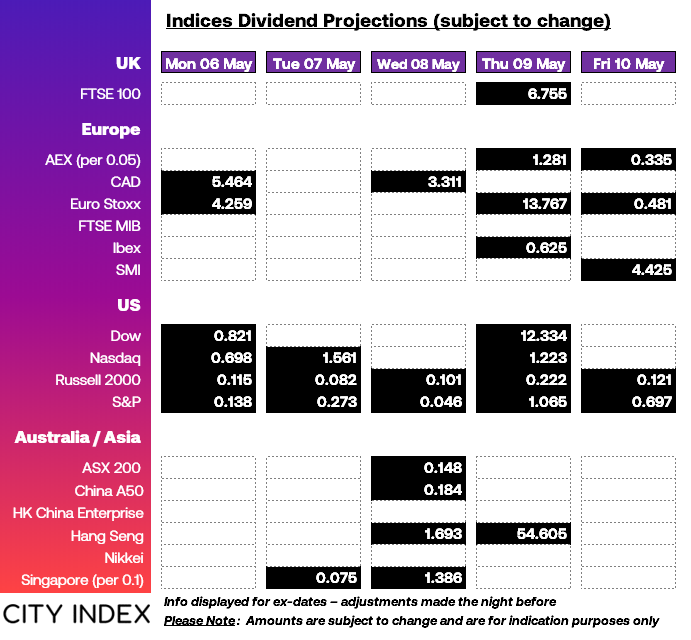

UK100 / EUROPE

Ftse closed on Monday for Bank Holiday, which presents a reasonably reliable shape on re-open, Tuesday. BOE announces their Interest Rate Decision at 9pm AEST on Thursday.

S&P 500

Quiet week on the data front, University of Michigan Consumer Sentiment Survey at midnight on Friday. High occurrence historically of heading higher, at least intra-day.

For TGM Subscribers, Friday recap and Monday preview / data parametres are below.

Have a great week everyone.

Cheers

Marto

TGM MORNING SESSION PREVIEW - MONDAY

Friday 3rd May 2024 Data Review

XJO Change: 39pts

AUS200 Futures Day Change: 17pts

Current AUS 200 Overnight Futures Pricing: 22pts

UK100 Change: 41pts

S&P500 Change: 51pts