AUSTRALIA 200 MARKET RECAP AND GLOBAL MARKET PREVIEW

June 3rd - June 7th, 2024

By request, this is an abridged cut and paste from the Morning and Evening Session Substacks for the week 27th - 31st May, excluding context and the premium daily data sets.

My aim with distributing this is to improve the education level and risk management skills of traders at all levels of experience through distribution of statistical data. As always, please feel free to reach out to me, or unsubscribe from any of my ramblings here.

AUS200 WEEKLY RECAP 27TH - 31ST MAY, 2024

Open: 7733

High: 7810

Low: 7594

Close: 7742

Change: -21pts (0.1%)

Monday 27th April 2024

Premarket Analysis:

Lack of direction generally expected today with no overseas leads. Outside of a ~50pts premarket rally on one previous occasion, potential for end of day moves lower look limited.

Postmarket Wrap:

Drifted higher as expected given the absence of any overseas lead.

Tuesday 28th May 2024

Premarket Analysis:

World markets re-opening so potential for some kind of unexpected move, however generally day before CPI is a snooze. No recorded falls of >20pts, or rallies of >30pts from 10am. Mean reversion, particularly on any weakness, looks to be the most likely trade.

Postmarket Wrap:

Small rally into close, but finished at the bottom end of expectations for pre-CPI.

Wednesday 29th May 2024

Premarket Analysis:

CPI today at 11:30am AEDT. More detailed info here.

15pts higher / 25pts lower or break of first hour range the LIS in terms of direction.

Unlikely to send any HP SMS Alerts this morning, as these events often skew the probabilities.

Postmarket Wrap:

Unusual for a material fall on the back of CPI to top after the first hour of trade, but other than that played out largely as would expect, and presented plenty of opportunity for profit based on historical parametres provided. Video recap here.

Thursday 30th May 2024

Premarket Analysis:

Historically following CPI induced falls we see a bounce back (largest CPI futures falls highlighted), although with current futures pricing, caution warranted.

Generally positive overnight moves into End of Month, with the largest moves higher coming from negative XJO leads (today finished down ~33pts).

Postmarket Wrap:

Rally from open on Aus200, following yesterday’s CPI inspired selloff.

80+pts rally from close overnight into End of Month.

Friday 31st May 2024

Premarket Analysis:

End of month. At time of writing futures are pricing in the largest XJO rally over the past 2 years on this day.

Likely to be a directional day. ~90% of days have day lows / highs in first hour and hit day highs / lows late in afternoon.

Postmarket Wrap:

HP Long successful. 21pts to Day High. Topped late afternoon.

NOTABLE MENTIONS - GLOBAL MARKETS

Long weekends on the FTSE continue to present highly profitable short opportunities on re-open, with another 47pts fall during first session. As an example running simple tiered short strategy over the past ~3years would have resulted in an average profit of 55pts per trade.

US GDP & PCE events continued the string of high probability long trading opportunities, each returning >20pts at a historical probability of >90%.

T20 World Cup, Pride Parades, and Planetary Alignments. None of this is likely to move markets. Here’s what you need to know:

GLOBAL MARKETS PREVIEW: WEEK BEGINNING 3RD JUNE

AUSTRALIA 200

Start of Month moves on Monday following the surge into close Friday will be one to watch. Usually expect a Gap down on open.

Australian GDP print on Wednesday usually provides some volatility.

UK100 / EUROPE

Quiet week on the event front, with only the ECB Interest Rate Decision on Thursday shaping as market mvoing.

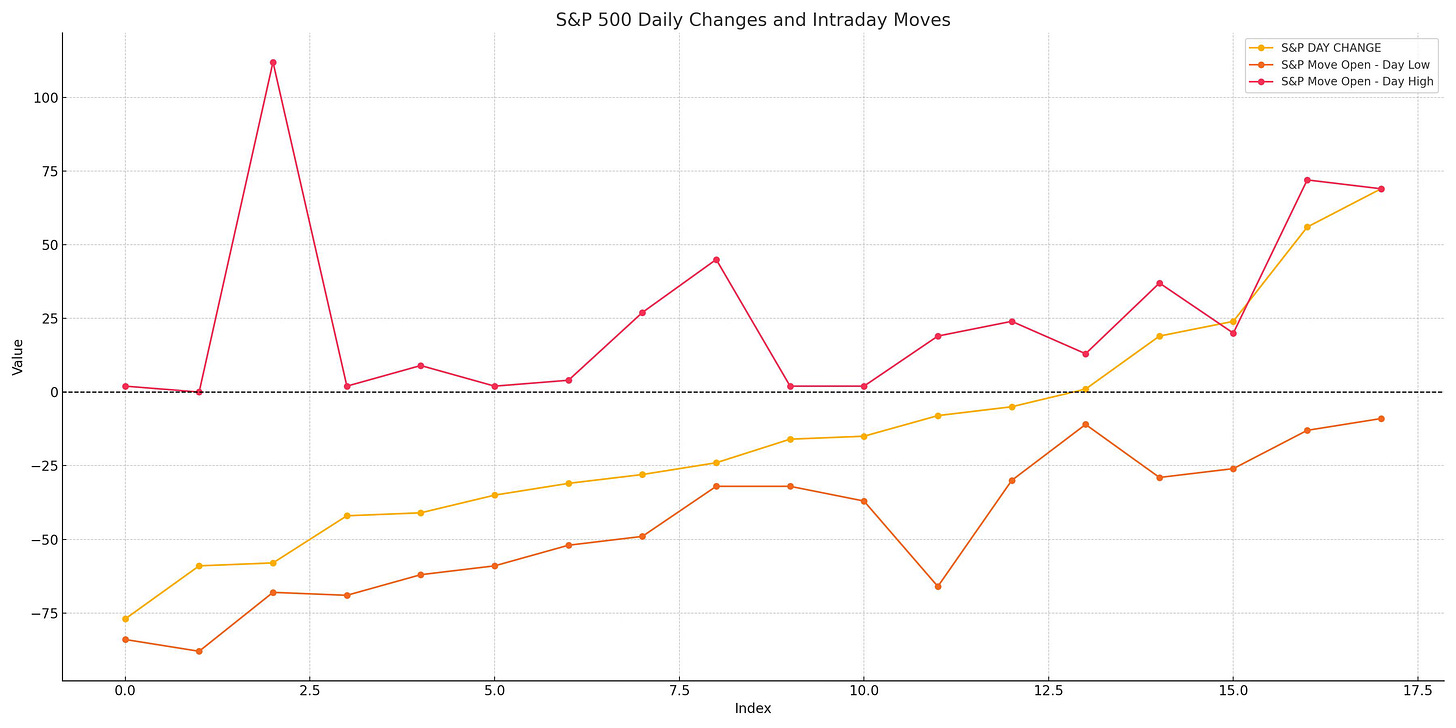

S&P 500

US PMI’s measuring the economic health of the non-manufacturing sector in the United States is out on Wednesday at midnight. Historically twice the intra-day moves to the downside vs upside.

US Non Farm Payrolls also out Friday at 10:30pm. The last 2 NFP releases have prompted a 50+ rally in the SPX.

For TGM AI-Insight Subscribers; Weekly Data Insights Video (SPX500: Post CPI Rally), Friday AUS200/ UK100/SPX500 recap and Monday preview / data parametres are below.

Have a great week everyone.

Cheers

Marto

TGM MORNING SESSION PREVIEW - MONDAY

Friday 31st May 2024 Data Review

XJO Change: 75pts

AUS200 Futures Day Change: 11pts

Current AUS 200 Overnight Futures Pricing: 46pts

UK100 Change: 41pts

S&P500 Change: 50pts