AUSTRALIA 200 MARKET RECAP AND GLOBAL MARKET PREVIEW

April 15th - 19th, 2024

By request, this is an abridged cut and paste from the Morning and Evening Session Substacks for the week 8th-12th April, excluding the premium daily data sets. As always, please feel free to unsubscribe from any of my ramblings here.

AUS200 WEEKLY RECAP 8TH-12TH APRIL

Open: 7809

High: 7875

Low: 7729

Close: 7744

Change: -65pts (-0.84%)

Monday 8th April 2024

Current futures pricing in +35pts. Past history would suggest a flat / lower finish from 10am most likely as we await global markets to re-open. If we don’t move higher from open, some reasonably large moves to intra day lows possible.

Most likely scenario played out, with market finishing lower. Chance to have a second go of it on the midday rally, given the likelihood of end of the day finishing lower.

Tuesday 9th April 2024

Not expecting any major excitement today, and no obvious edge found in the data from similar setups. Historically a high probability of falling <10pts intra day.

Moved 10pts lower from open, but equal lowest range of 21pts since April 2023. Finished flat.

Wednesday 10th April 2024

Usually muted end of day moves awaiting US CPI tonight.

Didn’t get the 20pts to lows that have occurred previously, however early highs were expected from the data, and presented an opportunity to trade back towards the open. Ended flat in line with majority of CPI days.

Thursday 11th April 2024

Post US CPI. Large overnight falls are usually reasonably well supported during our trading day, with no record of any large 2nd day falls. Most likely would be to see some falls first couple of hours, which have historically recovered sharply.

HP Short Successful. 17pts to Day Low.

Played out largely as expected. Early falls followed by a 75pts rally off lows.

Friday 12th April 2024

Futures results skewed to the downside in current setup. Friday, so first hour direction will be key.

Futures closed slightly lower as expected. Extremely unusual for there to be no follow through lower, after early falls on Friday.

NOTABLE MENTIONS - GLOBAL MARKETS

FTSE Tuesday setup had >2x more pts higher than lower, historically. Rallied 30pts from open. GDP reaction Friday the 2nd largest move higher over the past 4 years.

CPI Wednesday was the largest fall recorded when market has drifted higher into release. Immediate 80pts fall the largest reaction to the data since October 2022.

PPI Thursday was by far the biggest initial move higher on that release in over 3 years. Was a prelude to heading another 40pts higher in addition to the initial rally.

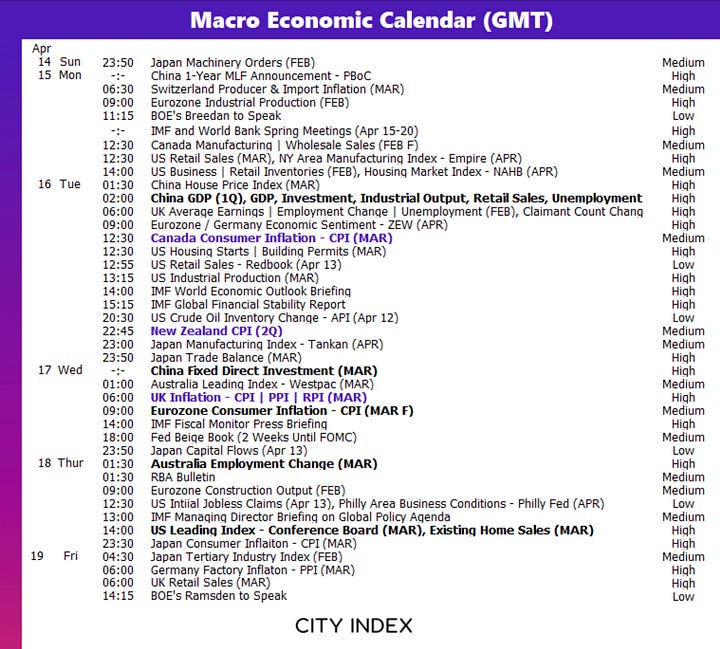

GLOBAL MARKETS PREVIEW WEEK BEGINNING 15TH APRIL

AUSTRALIA 200

Nothing material on the radar for the coming week. Expecting plenty of opportunities to trade from current volatility. Monday’s reaction to Friday night’s falls the immediate focus.

UK100 / EUROPE

UK CPI due Wednesday at 4pm AEST. Move between this release and market open will present trading opportunities.

S&P 500

Also a quiet week ahead on the data front. Weekend markets pricing for further falls on open Monday, and high probability of additional falls, intra-day.

Retail Sales on Monday 10:30pm AEST, however will likely be overshadowed by herd positioning following Friday night’s move lower.

Papa Powell has a recorded discussion on Wednesday at 3:15am AEST. Any time the Fed Chair opens his mouth, there’s potential for some market moves.

Options Expiry Friday. Herd mentality usually in full swing with >65% of days in trend mode, ending materially higher, or lower.

For TGM Subscribers, Monday preview and historical parametres are below.

Have a great week everyone.

Cheers

Marto

TGM MORNING SESSION PREVIEW - MONDAY

Friday 12th April 2024 Data Review

XJO Change: -32pts

AUS200 Futures Day Change: -5pts

Current AUS 200 Overnight Futures Pricing: -40pts

UK100 Change: 60pts

S&P500 Change: -75pts