AUSTRALIA 200 MARKET RECAP AND GLOBAL MARKET PREVIEW

June 24th - June 28th, 2024

By request, this is an abridged cut and paste from the Morning and Evening Session Substacks for the week 17th - 21st June, excluding context and the premium daily data sets.

My aim with distributing this is to improve the education level and risk management skills of traders at all levels of experience through distribution of statistical data. As always, please feel free to reach out to me, or unsubscribe from any of my ramblings here.

AUS200 WEEKLY RECAP 10TH - 14TH JUNE, 2024

Open: 7709

High: 7806

Low: 7676

Close: 7783

Change: +74pts (+0.97%)

Monday 17th June 2024

Premarket Analysis:

These days are usually quiet, with 93% of days finishing within 25pts of the open and 60% single digits from open. 87% have historically hit > 15pts lower.

Postmarket Wrap:

Minimal moves, suggested high probability of 15pts to low reached late in day.

Tuesday 18th June 2024

Premarket Analysis:

RBA Tuesday.

Additional RBA Tuesday range analysis is here.

Postmarket Wrap:

Strong opening lent significant weight to the upside scenario. Rallied another 20pts, however shrug of the shoulders on RBA announcement. Equal lowest 30 minute range following announcement, 4th smallest daily range over the past 3 years.

Wednesday 19th June 2024

Premarket Analysis:

RBA Wednesday.

Commonly gaps / pre-market down, then usually safe looking LONG following a positive RBA inspired XJO move, previous day (highlighted), with most first hour moves positive.

Postmarket Wrap:

Flat Open, spike early but small range, finished slightly lower.

Thursday 20th June 2024

Premarket Analysis:

Equity options expiry, and SPI rollover, so anything can happen. Usually a difficult day to trade, often with moves both ways.

Postmarket Wrap:

Flat. Equal 4th smallest trading range in the last 3 years.

Friday 21st June 2024

Premarket Analysis:

Historically on Triple Witch days, our market falls in the morning before rallying the afternoon. High incidence of moves both ways.

Postmarket Wrap:

HP Long successfu. 11pts to Day High.

Couldn’t have mapped the day much better. HP Long with a ‘U’ shape, typical of past Triple Witch days.

NOTABLE MENTIONS - GLOBAL MARKETS

Correllation between various equity markets has always been of interest to me, and an excellent example on Monday when we witnessed the UK100 fall significantly from open, while SPX held firm. Historically when this happens it’s a precursor to strength in the SPX from RTH and didn’t disappoint, rallying >70pts from pre-open lows.

I wrote on Thursday;

“We now have a situation where we have two consecutive events which have historically finished lower a high proportion of the time. Re-opening after US holiday today, followed by Triple Witch Friday.”

This was in stark contrast to last week where we had 2 largely bullish events slated on consecutive days (CPI & FOMC), which also finished higher.

In the end, falls were much less than history would have suggested likely (wonder if this is a bullish sign for the coming week?), but still provided an opportunity for >60pts from Thursday’s high to Friday’s low.

GLOBAL MARKETS PREVIEW: WEEK BEGINNING 24TH JUNE

AUSTRALIA 200

Aussie CPI 11:30am Wednesday. Recent reactions to the news would urge caution.

End of Month / End of Financial year also likely to present opportunities.

UK100 / EUROPE

UK GDP Tuesday at 4pm. Epect futures to rally into data.

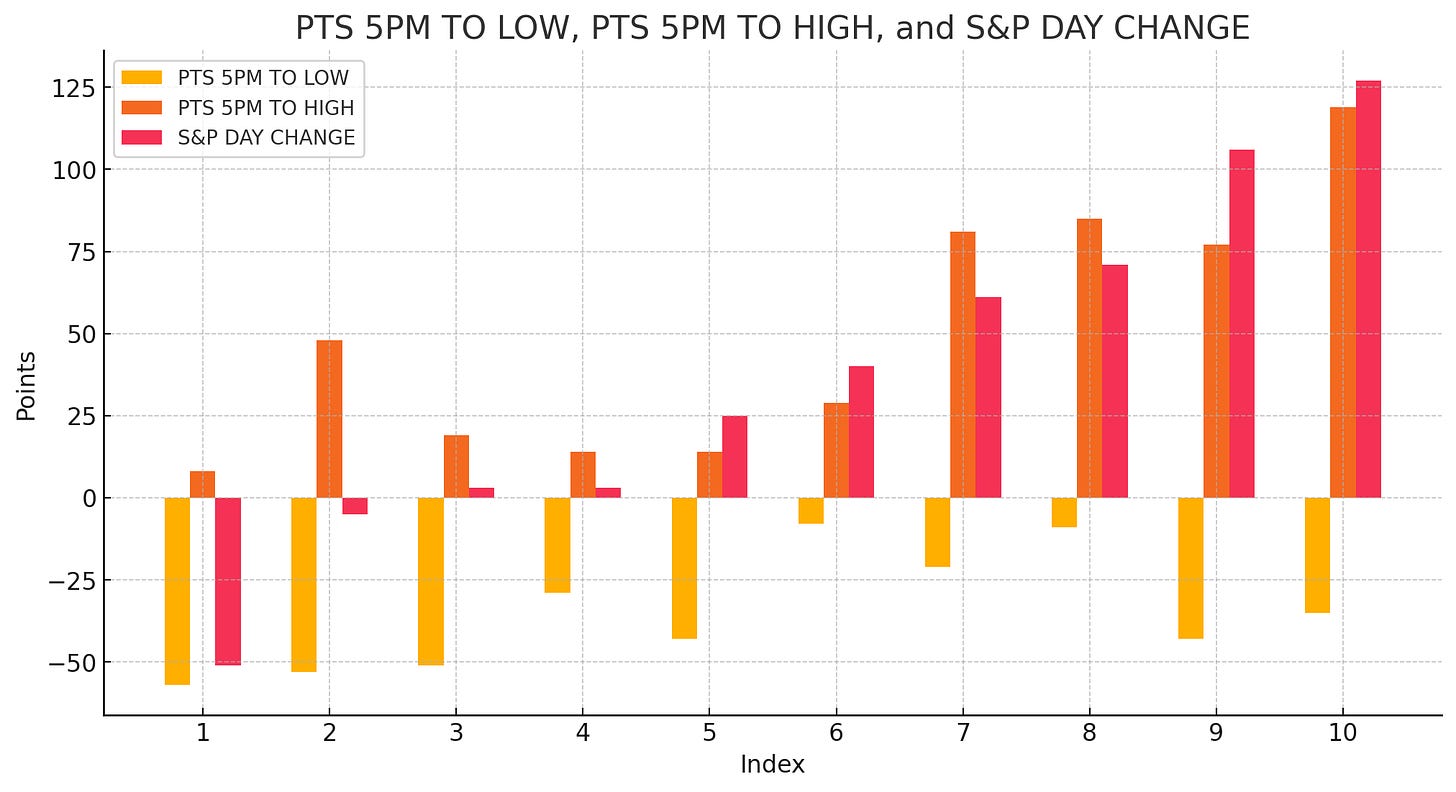

S&P 500

US GDP due out on Thursday at 10:30pm, followed by Personal Consumption Expenditures (PCE) at 10:30pm and End of Month on Friday should provide multiple trading opportunities to close out the week.

For TGM AI-Insight Subscribers; Weekly Data Insights Video (SPX500: Friday’s following Thursday Falls), Friday AUS200/ UK100/SPX500 recap and Monday preview / data parametres are below.

Have a great week everyone.

Cheers

Marto

TGM MORNING SESSION PREVIEW - MONDAY

Friday 22nd June 2024 Data Review

XJO Change: 32pts

AUS200 Futures Day Change: 15pts

Current AUS 200 Overnight Futures Pricing: -11pts

UK100 Change: -34pts

S&P500 Change: -4pts