AUSTRALIA 200 MARKET RECAP AND GLOBAL MARKET PREVIEW

June 17th - June 21st, 2024

By request, this is an abridged cut and paste from the Morning and Evening Session Substacks for the week 10th - 14th June, excluding context and the premium daily data sets.

My aim with distributing this is to improve the education level and risk management skills of traders at all levels of experience through distribution of statistical data. As always, please feel free to reach out to me, or unsubscribe from any of my ramblings here.

AUS200 WEEKLY RECAP 10TH - 14TH JUNE, 2024

Open: 7814

High: 7814

Low: 7666

Close: 7709

Change: -105pts (-1.3%)

Monday 10th June 2024

Premarket Analysis:

KINGS BIRTHDAY HOLIDAY. N/A

Postmarket Wrap:

KINGS BIRTHDAY HOLIDAY. N/A

Tuesday 11th June 2024

Premarket Analysis:

Historically when opening below XJO close Friday, we see the RTH session finish higher. 80+% of the time, the market bottoms in the first hour.

Postmarket Wrap:

HP Short Successful. 58pts to Day Low.

You have to follow the price action on a day like this, with potentially large moves. After the initial balance is lower, no recovery is likely.

Wednesday 12th June 2024

Premarket Analysis:

Awaiting major US data releases tonight. Usually trade in a small range not finishing far from open, ~80% hitting double digit moves higher, and lower.

Postmarket Wrap:

As expected, drifted both ways before finishing flat.

Thursday 13th June 2024

Premarket Analysis:

We need to look through both the Post-CPI and the Post-FOMC lenses.

Following CPI - One of the few days where a strong 15 minutes rally can often be wiped out throughout the day. Looking at prior rallies on the back of CPI, usually fade later in day, often hitting >20pts lower from open.

Following FOMC: ~73% occurrence of a >20pts fall from open following a bullish lead.

Postmarket Wrap:

Fell from open, 36pts to lows. Consistent with past moves.

Friday 14th June 2024

Premarket Analysis:

No clear bias in today’s data, looking to open relatively flat.

Postmarket Wrap:

Meandering day following early falls.

NOTABLE MENTIONS - GLOBAL MARKETS

Big week with CPI and FOMC released on the same day, which only happens roughly every 3 years. Recent history of when CPI & FOMC clumped together, continues to favour upside for swing traders into the events, with another ~80pts rally if you longed into the week. #fortunefavoursthebold

GLOBAL MARKETS PREVIEW: WEEK BEGINNING 17TH JUNE

AUSTRALIA 200

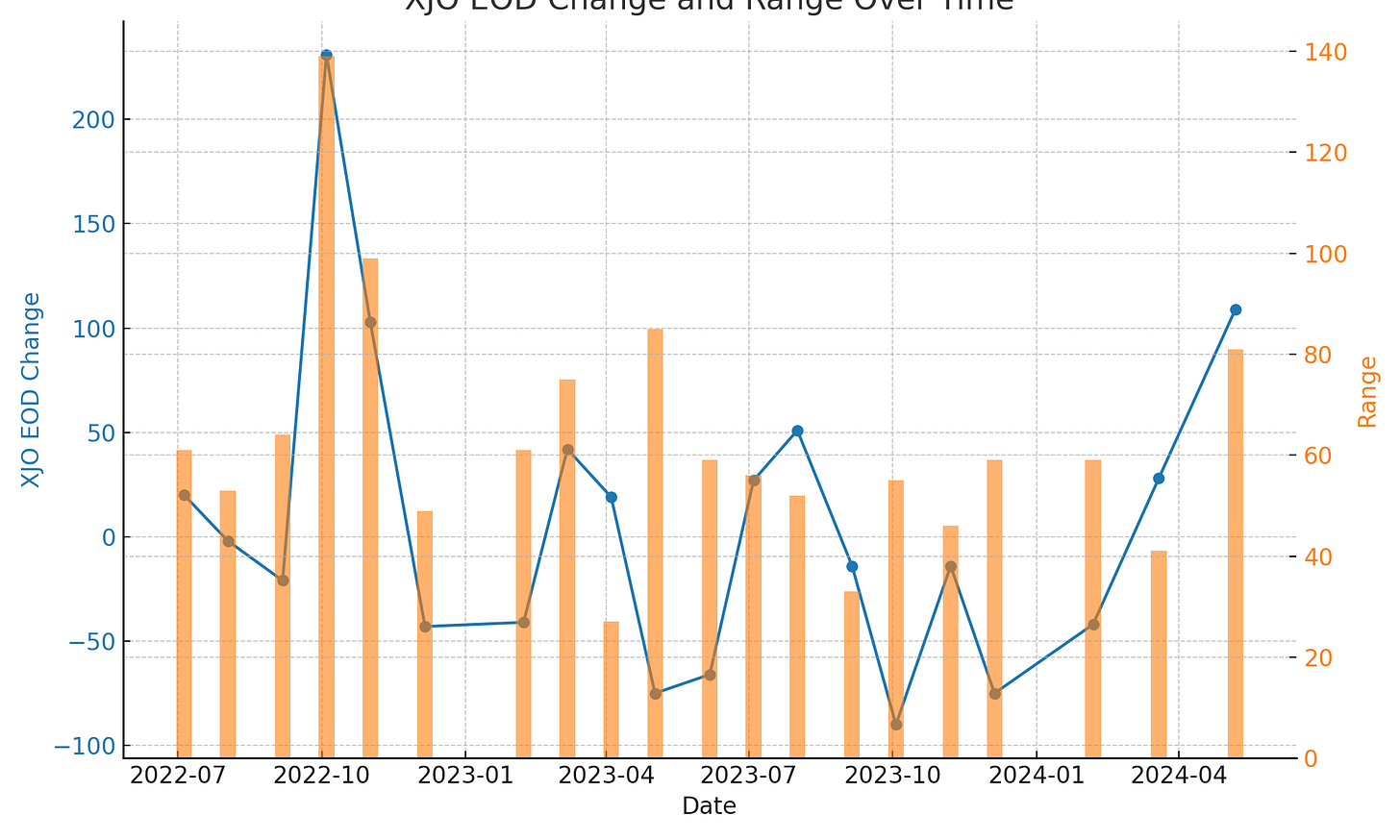

All eyes on the RBA Decision, Tuesday at 2:30pm on interest rates. Confidence seems to be returning to the equity market around this announcement since Ms Bullock took over. TGM Subs see video below running through the importance of early moves to end of day outcomes.

UK100 / EUROPE

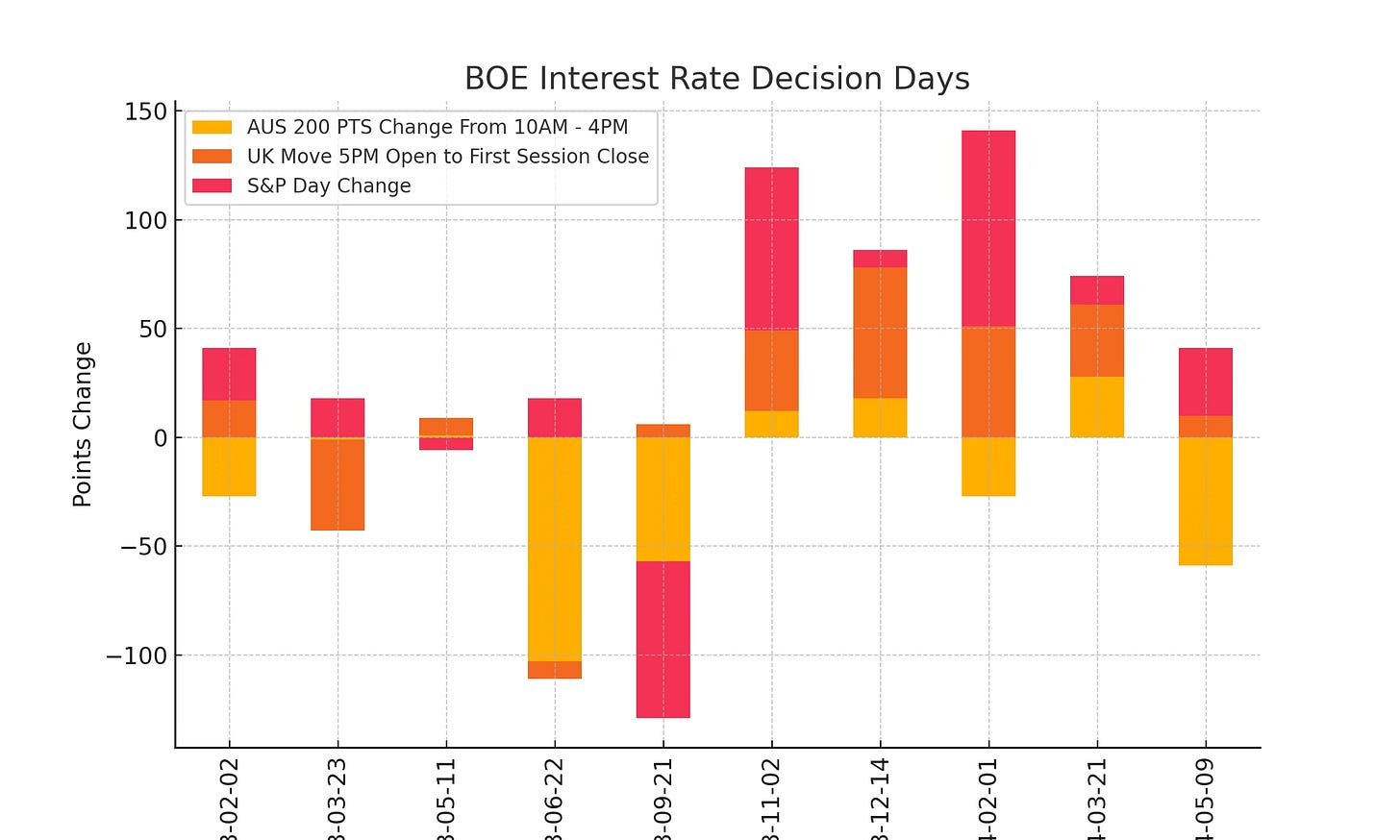

Big week in terms of market sensitive data out of the Eurozone, with Euro CPI Tuesday at 7pm, UK CPI Wednesday at 4pm leading into Thursday’s 9pm BOE Interest Rate announcement. Recent data shows the AUS200 significantly underperforming vs UK & USA markets on these days.

S&P 500

Bit of a dearth of data this week following last week’s excitement. Retail Sales on Wednesday at 10:30pm.

For TGM AI-Insight Subscribers; Weekly Data Insights Video (AUS200: RBA Tuesday Initial Moves), Friday AUS200/ UK100/SPX500 recap and Monday preview / data parametres are below.

Have a great week everyone.

Cheers

Marto

TGM MORNING SESSION PREVIEW - MONDAY

Friday 15th June 2024 Data Review

XJO Change:-21 pts

AUS200 Futures Day Change: -11pts

Current AUS 200 Overnight Futures Pricing: -20pts

UK100 Change: -16pts

S&P500 Change: 1pts