AUSTRALIA 200 MARKET RECAP AND GLOBAL MARKET PREVIEW

May 27th - May 31st, 2024

By request, this is an abridged cut and paste from the Morning and Evening Session Substacks for the week 20th - 24th May, excluding context and the premium daily data sets.

My aim with distributing this is to improve the education level and risk management skills of traders at all levels of experience. As always, please feel free to reach out to me, or unsubscribe from any of my ramblings here.

AUS200 WEEKLY RECAP 20TH - 24TH MAY, 2024

Open: 7857

High: 7881

Low: 7713

Close: 7769

Change: -88pts (-1.1%)

Monday 20th April 2024

Premarket Analysis:

Some large premarket moves likely, and possible large moves to lows before potential recovery looking at similar past setups.

Postmarket Wrap:

HP Short Successful. 12pts to Day Low.

Roughly as expected although volatility was significantly lower than expected.

Tuesday 21st April 2024

Premarket Analysis:

Historically futures struggle to finish materially higher under current setup. The only decent end of day rallies moved higher directly from open.

Postmarket Wrap:

Snooze. 20pts range.

Wednesday 22nd May 2024

Premarket Analysis:

Go fishing / surfing / duck hunting. Mean reversion trades look best.

Postmarket Wrap:

Funds unexpectedly headed for the exits from midday. Likely de-risking with so much upcoming uncertainty tonight (UK CPI, Fed Minutes, NVIDIA reporting). Did not stop fallinng overnight.

Thursday 23rd May 2024

Premarket Analysis:

On the face of it our market seems oversold, currently pricing in ~85pts of falls, while the S&P finished only slightly lower. However similar past setups also suggest more intra day falls likely. Past rallies have repriced directly from open.

Postmarket Wrap:

HP Alert Short Successful. 13pts to Day Low.

Unusual to get that kind of recovery given the setup, and weak initial first hour moves. But suppose that can happen when the SPX futures trade 30pts higher.

Friday 24th May 2024

Premarket Analysis:

Unusual for our futures to dump into a Friday after XJO finishes lower Thursday. Previous days highlighted below.

82% will reach 10pts lower. If you’re looking for a large directional move, 7/8 largest falls, and the 3 largest rallies have all moved pretty much from open, with only single digit moves against. Anything more eithe way, expect chop.

Postmarket Wrap:

10pts lower reach in early fall, which voided any potential move higher, and first hour move voided any potential move lower. Flat finish.

NOTABLE MENTIONS - GLOBAL MARKETS

SPX had its 5th largest premarket drop in the last 1000 trading days on Thusday following NVIDIA euphoria. Large moves like this usually dish up excellent, relatively predictable trading opportunities during RTH, with an average additional range of 86pts from open.

The FTSE also had the largest pre-market move in either direction for CPI Wednesday with a 65pts fall 4-5pm following the announcement.

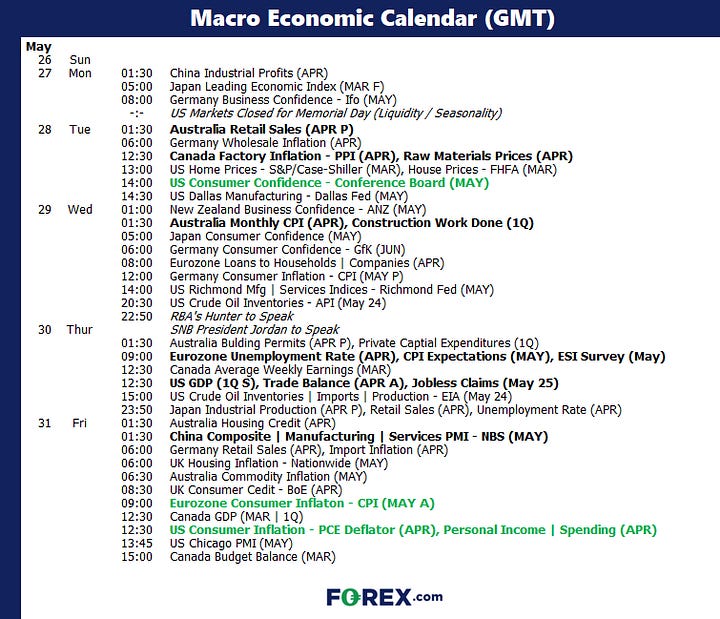

GLOBAL MARKETS PREVIEW WEEK BEGINNING 27TH MAY

AUSTRALIA 200

Not expecting any large moves Monday with both major markets shut. CPI Wednesday, and End of Month flows towards end of week.

Last 10 Futures moves on CPI days:

UK100 / EUROPE

FTSE closed for a Bank Holiday Monday. UK100 enters the market re-opening in the green 87% of the time, so would expect some upward pressure on futures reopen.

S&P 500

NYSE closed for Memorial Day on Monday. Consumer Confidence on Tuesday at midnight, GDP at 10:30pm Thursday. PCE has moved the market less than 25pts last 8 sessions, however prior to that was a volatile event. Expect End of Month to add some volatility.

For TGM Subscribers; Weekly Data Insights Video (AUS200: Break of Initial Range), Friday AUS200/ UK100/SPX500 recap and Monday preview / data parametres are below.

Have a great week everyone.

Cheers

Marto

TGM MORNING SESSION PREVIEW - MONDAY

Friday 24th May 2024 Data Review

XJO Change: -71pts

AUS200 Futures Day Change: 3pts

Current AUS 200 Overnight Futures Pricing: 35pts

UK100 Change: -21pts

S&P500 Change: 35pts