AUSTRALIA 200 MARKET RECAP AND GLOBAL MARKET PREVIEW

April 22nd - 26th, 2024

By request, this is an abridged cut and paste from the Morning and Evening Session Substacks for the week 15th-19th April, excluding the premium daily data sets. As always, please feel free to unsubscribe from any of my ramblings here.

AUS200 WEEKLY RECAP 15TH-19TH APRIL

Open: 7754

High: 7790

Low: 7494

Close: 7602

Change: -152pts (-2.01%)

Monday 15th April 2024

Historically 81% probability of hitting >10pts higher, and 88% of hitting >10pts lower from RTH open. Previously any rallies have had a flat / higher Gap & Pre-market, and bottomed first 15 minutes.

Choppy as expected. As soon as the 10-10:15 low was breached, no prospect of any meaningful rally, despite S&P mooning.

Tuesday 16th April 2024

Fairly even split higher and lower under this setup, and XJO history suggests fairly priced. Best to let a break of the first half hour range dictate likely direction.

HP Short Successful. 107pts to Day Low. Trend lower all day. Break of 10:30 low showed the way.

Wednesday 17th April 2024

Historically either need to move higher from open with minimal moves lower, or we’re in for more material intra day & posibly end of day falls.

Nothing day. Finished flat.

Thursday 18th April 2024

Options Thursday. Can often see some large swings both ways. Around 2x more points to the downside than upside when overnight futures positive, historically.

HP Long Successful. 21pts to Day High. Extremely unusual to have such a small range after a Gap / Pre-Market move like we had.

Friday 19th April 2024

Should be able to expect decent trading opportunities today, with 94% of past setups ranging > 40pts, average 75pts.

History of large falls into weekend, and overall outcomes skewed to the downside.

Historically anything above a single digits futures rally intra day (ie ~7596) would present a good short opportunity from a R/R perspective, with 88% of days finishing lower.

Carnage from open, which looking at the data was always a reasonable probability. Plenty of opportunity to get set short if missed the open, given the minimum expected range which needed to be filled.

NOTABLE MENTIONS - GLOBAL MARKETS

High probability we would see large SPX500 day falls known within the first few minutes of the AUS200 open on Friday, but did not expect the speed and strength of the early move. 70pts or ~1.4% fall to lows during our session.

Wednesday saw the most bullish finish for the FTSE following a negative initial CPI reaction (premarket down 29pts), closing 28pts higher.

GLOBAL MARKETS PREVIEW WEEK BEGINNING 22ND APRIL

AUSTRALIA 200

CPI Wednesday at 11:30am AEST. Average move for these days is higher, with ~70% of days finishing in the green.

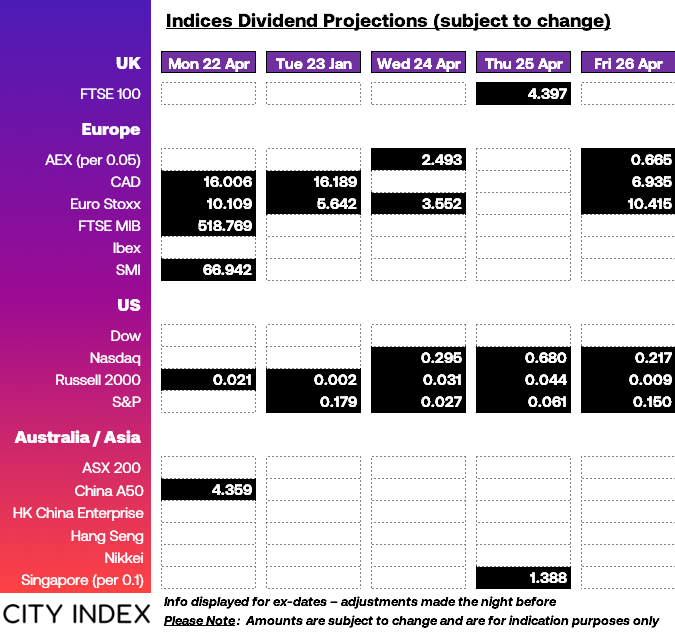

UK100 / EUROPE

Nothing of note.

S&P 500

My favourite data release, GDP on Thursday at 10:30pm AEST.

One of the big daddy data releases with PCE on Friday at 10:30pm AEST. Average range of 85pts and given recent volatility, this one should be particularly spicy and present excellent trading oportunities.

For TGM Subscribers, Friday recap video and Monday preview / data parametres are below.

Have a great week everyone.

Cheers

Marto

TGM MORNING SESSION PREVIEW - MONDAY

Friday 19th April 2024 Data Review

XJO Change: -69pts

AUS200 Futures Day Change: -14pts

Current AUS 200 Overnight Futures Pricing: 30pts

UK100 Change: 19pts

S&P500 Change: -44pts